Unusual Options Activity in Nano-X Imaging Ltd. (NNOX), Momentus Inc. (MNTS), and Cameco Corporation (CCJ)

Unusual Options Activity in Nano-X Imaging Ltd. (NNOX)

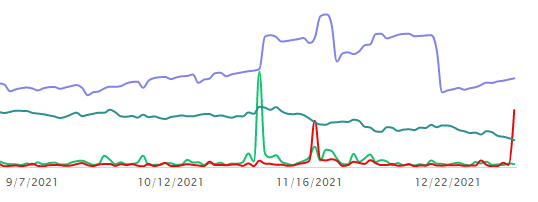

Today, January 10, 2022, in the Nasdaq Global Market Composite (NasdaqGM), we saw unusual or noteworthy options trading volume and activity in Nano-X, which opened at $12.61.

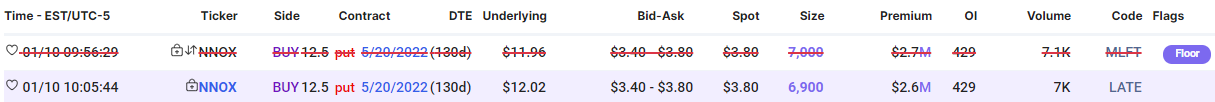

- There were, originally, 7000 contracts traded on the $12.5 strike put option dated for May 20th, 2022, bought to open at the ask. However, these orders were cancelled, hence why they were struck through.

- Approximately 9 minutes later, there were 6,900 contracts traded on the same strike and date, and reported as “late”.

Trades that are struck through have been cancelled for one reason or another. Trades can be modified or nullified for a variety of reasons, and per the SEC:

for the maintenance of a fair and orderly market.

Exchanges can erroneously send more trades than were actually placed, especially during times of high volume. This is a normal occurrence.

Read more about floor traders and their performance on the Unusual Whales blog here.

These orders come after Jon Quast of The Motley Fool reported:

The stock price just keeps tumbling for the company that aspires to revolutionize the X-ray industry, having now declined 84% from its high in 2021.

As of this writing, Nano-X has had 69,174 puts traded, which is 7,635% greater than its 30-day put average.

To view more information about NNOX's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Momentus Inc. (MNTS)

In the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity in Momentus Inc. (MNTS), which opened today at $4.09.

- There were at least 1,782 contracts traded from a plethora of traders on the $2.5 strike call option dated for May 20th, 2022, primarily traded at the ask.

- These trades were detected using the new Unusual Whales Hottest Chains & Tickers panel, seen here.

These orders come after Simply Wall St reported that:

In the last twelve months, the biggest single sale by an insider was when the President, Fred Kennedy, sold US$581k worth of shares at a price of US$7.58 per share.

The May 20th, 2022 $2.5 call options in this report are the largest sized bets on Momentus today and in recent history.

As this company has a market capitalization of approximately $277M, however, it must be stated it cannot be apparent as to why these trades are being made without a publicly understood catalyst.

To view more information about MNTS's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Cameco Corporation (CCJ)

Finally, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Cameco Corporation (CCJ), which opened today at $23.35.

There were a series of cross trades, all traded on the March 18th, 2022 expiration date:

- There were 10,000 contracts traded on the $26 strike call option,

- Additionally, there were 2,000 contracts traded on the $26 strike call,

- Another 18,000 contracts on the $32 strike call,

- And finally, 2,000 contracts on the $21 strike put option; however the size of this order and its overall volume thus far on the day is not greater than the open interest on the chain (of approximately 5,000 contracts in circulation as of this morning’s open).

- Otherwise, the first three trades in this set of cross trades all had greater sizes and volumes than their open interests as of this morning’s open, implying these orders were all bought or sold to open, not closed.

A tip from the flow: Trades appended with a briefcase emoji can be intuited as bought or sold to open. This determination is made if the size of the trade was greater than the chain's open interest.

Only trades that can be positively identified as being bought or sold to open will be marked as such (with the briefcase).

Be mindful! Trades without the briefcase emoji might still have been bought or sold to open!

As stated, the orders in this report were cross trades:

A cross trade occurs when a broker executed buy and sell orders for this same position from different client accounts and then reported them on an exchange. In other words, these are an aggregation of many positions taken on both the buy and sell side.

These orders come after Steve Gray Booyens of TipRanks wrote that:

Cameco could suffer from income statement pressure if wage demands and non-core inflation continue to grow with stagnation inventory value. The miners could be set for a period of downward mean reversion in 2022 if this situation would fully manifest itself, especially considering their outperformance last year.

50.6% of the premium traded at these premium levels are in bullish bets, with 60.9% as ask-side orders, and 89.7% are in call premiums.

To view more information about CCJ's flow breakdown, click here to visit unusualwhales.com.