Unusual Options Activity in NIO Inc. (NIO), Farfetch Limited (FTCH), and Hub Group, Inc. (HUBG)

Unusual Options Activity in NIO Inc. (NIO)

Today, November 12, 2021, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in NIO Inc., which opened at $42.69.

There were several hundred contracts traded on the $45 strike put option, bought at the ask, dated for January 21st, 2021.

The options order flow totals approximately 57.87% in bullish premium traded, with 119,600 calls, amounting to $16,400,000 in premium, traded.

These orders come after John Rosevear of The Motley Fool reported that NIO Inc. reported a loss for the third quarter that was narrower than Wall Street had expected, on good sequential and year-over-year sales growth despite a series of manufacturing challenges.

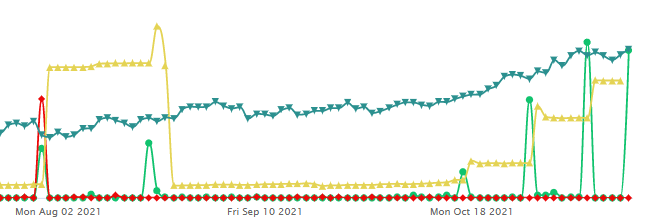

As seen, the $45 and $43 strike calls dated for January 21st and November 12th, respectively, were both above ask orders, signified by the tag “SingleLegTradesAboveNbboAsk”, revealing a buyer was willing to move these trades above the ask, signifying a bullish sentiment.

To view more information about NIO's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Farfetch Limited (FTCH)

Again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Farfetch Limited (FTCH), which opened today at $46.63.

There were 13,830 contracts traded on the $50 strike call option, dated for November 19th, 2021, bought to open at the ask.

Additionally, there were 6,915 contracts traded on the $45 strike call option at the bid, for the same date.

These contracts represent approximately 2,074,500 shares and $3,600,000 in premium traded.

In addition to the above, it is suspected a series of put orders came through, potentially from the same trader or entity:

These orders after Simply Wall St reported that Farfetch Limited:

“Over the last three years Farfetch has grown its revenue at 48% annually. That's much better than most loss-making companies. The stock is up 19% over that time - a decent but not impressive return.”

As can be seen, there is downside protection with the sold calls, but a range between $45.80 and $54.33 where the trade assumes a risk.

To view more information about FTCH's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Hub Group, Inc. (HUBG)

Finally, and in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in Hub Group, Inc. (HUBG), which opened at $82.98.

There were 1,920 contracts traded on the $85 strike call option, bought to open at the ask, dated for December 17th, 2021.

Additionally, there were another 1,920 contracts traded on the $90 strike call option also at the ask and for the same date; however, the open interest on this chain was already 3,000, so it is not apparent whether these orders were to open or otherwise.

These orders represent approximately 384,0001 contracts and $710,000 in premium traded.

These orders come after RTTNews reported Hub Group, Inc. earnings totaled $43.3 million, or $1.28 per share. This compares with $24.8 million, or $0.74 per share, in last year's third quarter..

As of this writing, Farfetch Limited has had 6,035 calls traded, which is 1,461% greater than its 30-day call average.

To view more information about HUBG's flow breakdown, click here to visit unusualwhales.com.