Unusual Options Activity in Nokia Oyj (NOK), Anaplan, Inc. (PLAN), and SoFi Technologies, Inc. (SOFI)

A Review of Unusual Options Activity in Nokia Oyj (NOK)

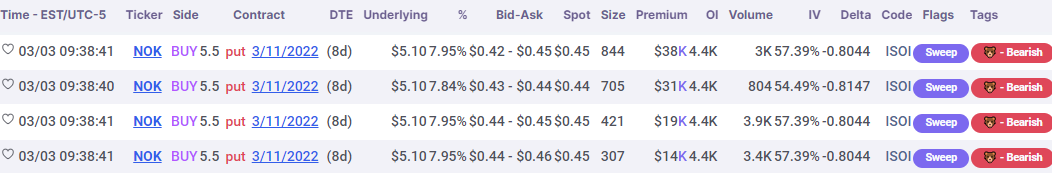

Today, March 03, 2022, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Nokia, which opened at $5.15.

- There were a series of contracts swept-to-fill on the $5.5 strike put option traded at and around $0.45 with a bid-ask spread of $0.42 to $0.45.

- The open interest on this chain is 4,423; the total volume thus far today is 4,439. Therefore, it must be stated that these orders could have just as easily been swept-to-fill to close existing positions, even closer to or at the ask. The only way to know whether these orders were in fact to open would have been if the volume or the overall sizes of the trades exceeded the open interest on the chain.

These orders come just after Nokia posted its latest earnings report.

As seen, the open interest and volume are almost identical; therefore, there cannot be a determination as to whether these contracts were opened or closed. Always be mindful that active or emergent volume is not indicative of direction!

As stated, these orders were marked as a “sweep”. An options sweep (or sweep-to-fill) occurs when a broker splits an order into many parts in order to get the best possible pricings currently offered on the market.

- These orders can often be filled across multiple exchanges and the broker will continue to fill the order lot by lot, always for the best possible price, until the order is completely filled.

- Sweeps might stand out because they imply some entity (or entities) wanted to enter specific options contracts regardless of their price, as they were focused only on having their entire bulk order filled as quickly as possible. While the magnitude of sweeps might stand out, each one must be investigated thoroughly to understand what the sentiment of a trader is as compared to the overall flow.

To view more information about NOK's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Anaplan, Inc. (PLAN)

Again in the NYSE, we saw unusual or noteworthy options trading volume and activity Anaplan, Inc. (PLAN), which opened today at $53.95.

- There was one set of 1,650 contracts and then two sets of 825 contracts traded on the $55 strike call option dated for March 18th, 2022 bought to open at the ask for $1.27, $1.29, and $1.30 with a bid-ask spread of $0.80 to $1.35.

- The open interest on this chain was 3,617; the overall volume has thus far been 3,366 contracts traded. Yesterday’s open interest was 2,740 after having experienced 1,259 volume, which implies the traders yesterday remained in these positions into today.

These orders come after Anaplan came out with a quarterly loss of $0.11 per share. This compares to a loss of $0.07 per share a year ago.

This chain began seeing noteworthy activity on the 28th in the amount of 2,531 contracts traded, which carried over into the 1st, as well. Therefore, we may intuit that this is either a continuation of that trend, or in fact all of these traders are exiting today.

To view more information about PLAN's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in SoFi Technologies, Inc. (SOFI)

Finally, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity in SoFi Technologies, Inc. (SOFI), which opened today at $11.49.

- There were 10,000 contracts traded on the $20 strike put option dated for July 15th, 2022 bought to open at the ask at a spot price of $9.32 with a bid-ask spread of $9.20 to $9.40.

- The open interest on this chain was 7,712 contracts and the overall volume is now 10,006 as of this writing.

Alongside the aforementioned $20 strike puts were $20 strike calls for the same date, also with 10,000 contracts traded, but traded at the bid of $0.36 with a bid-ask spread of $0.36 to $0.37.

However, the open interest on this chain was approximately 23K, and the overall volume thus far today is just 10K, so it cannot be determined if these contracts were opened or closed, or used with the put as a part of a multileg strategy.

A tip from the flow: Trades appended with the ↕ and 🔃 emojis are trades that have potentially came in together as a part of a strategy, and are coded accordingly (such as MLET or TLCT) under the codes column. Clicking on these emojis will open all of the trades that came in together so that the holistic strategy may be investigated.

Furthermore, these orders come after Dana Blankenhorn from InvestorPlace continued to recommend SoFI.

Of interest, these orders were marked as “floor”. Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag. Click here to read about floor traders' performance.

To view more information about SOFI's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.