Unusual Options Activity on Rocket Lab (RKLB) Around News of Satellite Launch and Business Acquisition

October 12, 2021

10:42am ET

Yesterday, Monday October 11, 2021, Rocket Lab USA (RKLB) announced that it has scheduled not one, but two dedicated satellite launches for Spaceflight Industries’ geospatial intelligence company, BlackSky. The launches, scheduled for November, will deploy Gen-2 satellites for high-resolution imaging of Earth.

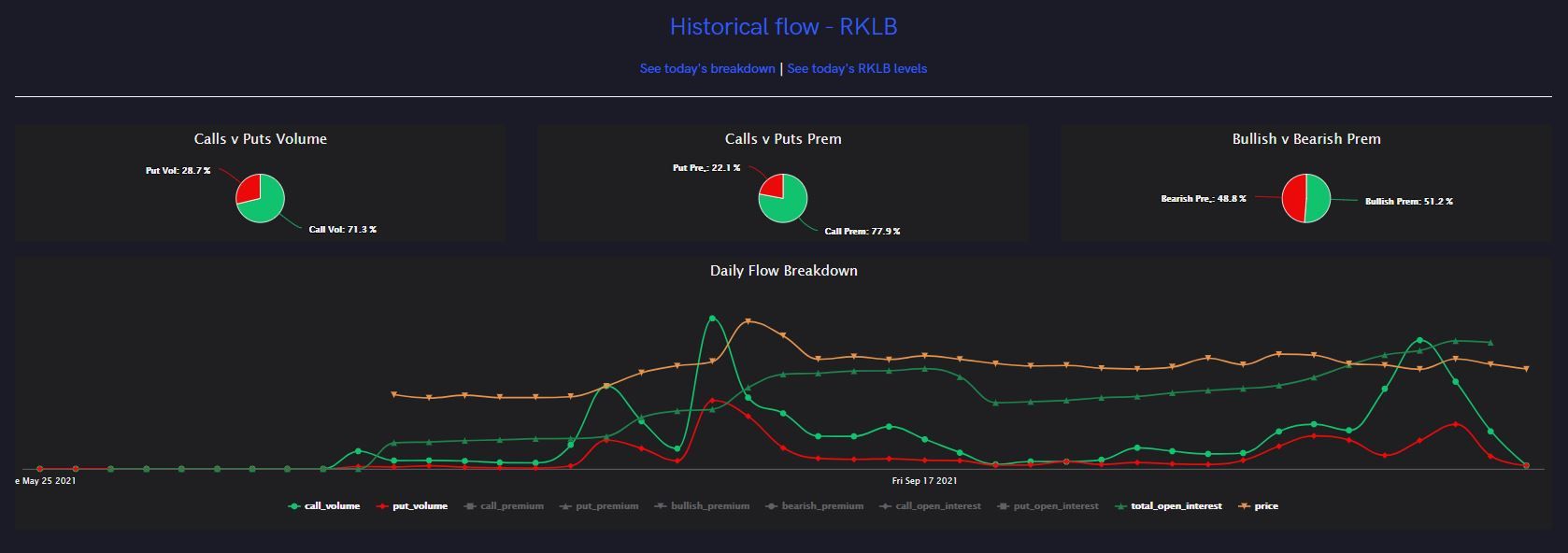

Options flow both before and after this news demonstrated options traders’ sentiment for the company leaned bullish.

In the image above, orders with premiums ranging from $100k to over $3 million flowed in over the course of a few days (from October 8th to October 11th); some displaying multi-leg strategies with a bullish lean. Predominantly focused on deep in the money strikes (namely the $1 and $5 strikes), these orders were heavily stacked on the October 15 expiration date.

This could potentially be due to the traders’ desire to see a short-term spike on this news, or they could be attempting to obtain shares via their contracts near the date of expiration. Some of these flow orders, on similar strikes no less, are dated for January and April of 2022; indicative of the same sentiment, over a longer period of time.

Both of these possibilities could indicate bullish sentiment, though acquiring shares surely paints a more bullish picture for the long term.

This morning, Tuesday October 12, Rocket Lab (RKLB) made yet another announcement: closure of the purchase of Colorado aerospace engineering firm Advanced Solutions, Inc. Rocket Lab purchased the company for $40 million, with a potential additional earnout of $5.5 million. Advanced Solutions, which provides space flight software and test systems, is expected to strengthen the RKLB portfolio.

Flow this morning following the announcements is somewhat mixed, however, bullish premiums still outweigh bearish premiums 53% to 47% at the time of writing.

Much like the previous day’s flow, the expiration date of focus is October 15, 2021 for both bearish and bullish orders. Calls sold at the bid for longer dated expiration dates, namely the $20 call strike for January 2023, could reflect an investor’s desire to protect any downside to their owned shares in the meantime.

RKLB is currently down around 8.77% in the last 30 days, however the stock is still positive by a factor of +3.21 (29.61%) in the last 6 months. So far this morning, the stock has traded between $13.91 and $14.20.