Unusual Options Activity in Opendoor Technologies Inc. (OPEN), DICK'S Sporting Goods, Inc. (DKS), and Delta Air Lines, Inc. (DAL)

Unusual Options Activity in Opendoor Technologies Inc. (OPEN)

Today, December 02, 2021, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in Opendoor Technologies Inc., which opened at $14.63.

There were 1,798 contracts traded on the $16 strike call option dated for January 21st, 2022, bought to open at the ask.

These orders come after Trevor Jennewine and Travis Hoium of The Motley Fool reported why Opendoor stock shot higher after Q3 earnings.

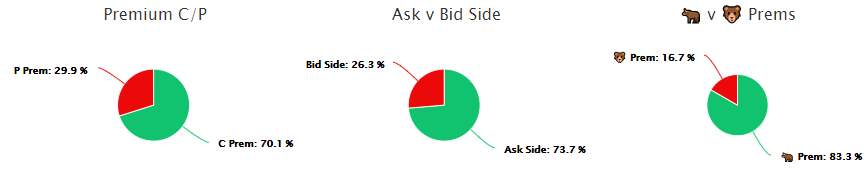

87.9% of the premium traded at these premium levels are in bullish bets, with 71.7% as ask-side orders, and 71.2% are in call premiums.

To view more information about OPEN's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in DICK'S Sporting Goods, Inc. (DKS)

Among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in DICK'S Sporting Goods, Inc. (DKS), which opened today at $115.34.

- There were 6,238 contracts traded on the $125 strike call option, dated for January 21st, 2022.

- Note well, on DICK'S Sporting Goods, Inc. goes ex dividend at the amount of $1.75 on December 9th, 2021.

- As such, large, deep in the money call options are often ordered to capitalize on the dividend. It might be a consideration to therefore trade differently around companies who are posting a dividend in the coming days or weeks.

These orders come after DICK'S Sporting Goods, Inc. reported better-than-expected results for the third quarter ended October 30, 2021. An increase in net sales was the primary driver of the strong results.

As of this writing, DICK'S Sporting Goods, Inc. has had 7,949 calls traded, which is 132% greater than its 30-day call average.

To view more information about DKS's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Delta Air Lines, Inc. (DAL)

Finally, and again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Delta Air Lines, Inc. (DAL), which opened at $34.41.

- There were 15,000 contracts traded on the $38 strike call option, dated for December 17th, 2021.

- These orders were a part of a cross trade, meaning a broker executed the order by matching buy and sell orders for the same security across various client accounts, and then reported them as such.

These orders come after a 7.6% setback yesterday.

83.3% of the premium traded at these premium levels are in bullish bets, with 73.7% as ask-side orders, and 70.1% are in call premiums.

To view more information about DAL's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.