Unusual Options Activity in Palantir Technologies Inc. (PLTR), MGM Resorts International (MGM), and First Horizon Corporation (FHN)

A Review of Unusual Options Activity in Palantir Technologies Inc. (PLTR)

Today, February 28, 2022, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Palantir, which opened at $11.96.

- There were 13,500 contracts traded on the $20 strike call option dated for April 14th, 2022, traded at the ask of $0.08 with a bid-ask spread of $0.07 to $0.08. These contracts are 73.11% out of the money, with Palantir having opened at and currently trading around $11.96.

Additionally, these orders come after reports as to why Palantir was still trending downward Friday, February 25th.

Of interest, these orders were marked as “floor”. Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag.

Click here to read about floor traders' performance.

A tip from the flow: Trades appended with a briefcase emoji can be intuited as bought or sold to open. This determination is made if the size of the trade was greater than the chain's open interest. Only trades that can be positively identified as being bought or sold to open will be marked as such (with the briefcase).

To view more information about PLTR's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in MGM Resorts International (MGM)

Today, February 28, 2022, again in the NYSE, we saw unusual activity in MGM Resorts International (MGM), which opened today at $44.26.

- There were a series of orders on the $39.5 strike puts dated for March 4th, 2022, traded at the ask of $0.19 to $0.20 with a bid-ask spread of $0.15 to $0.20 thus far this morning.

- Furthermore, these orders come before MGM Resorts’s ex-div date on March 9th, 2022.

A tip from the flow: Beware of ex-dividend dates! You might want to avoid trading calls surrounding a stock's ex-dividend date, even if the options order flow shows a lot of call volume: You might be seeing traders that are looking to capture as much of the dividend as possible, who are looking to exercise deep ITM call options. As this date is not until next week, this is not likely the case with the above orders.

These options were detected using the NEW Unusual Whales hottest chains tool. These orders came in in small segments but amounted to the approximate 4K volume as seen, which might have otherwise been missed if not diligently watching the live order flow.

To view more information about MGM's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in First Horizon Corporation (FHN)

Finally, and again in the NYSE, we saw unusual or noteworthy options trading volume and activity in First Horizon Corporation (FHN), which opened today at $24.15.

- There were 1,000 contracts cross traded on the $20 strike call option dated for January 20th, 2023 bought to open at the ask of $4.50 with a bid-ask spread of $4.30 to $4.50.

- The premium spent amounted to $450K and the open interest on this chain as of this morning was approximately 3K; therefore, it cannot be entirely understood as to whether these options were in fact to open or to close from the volume and open interest alone.

- Additionally, these orders come after news that First Horizon shares “are surging more than 29% Monday morning on the news of it being acquired by TD Bank Group (TD) in a transaction valued at $13.4 billion, to be paid in cash.”

As stated, the orders in this report were cross trades:

Cross trades occur when a broker executed buy and sell orders for this same position from different client accounts and then reported them on an exchange. In other words, these are an aggregation of many positions taken on both the buy and sell side.

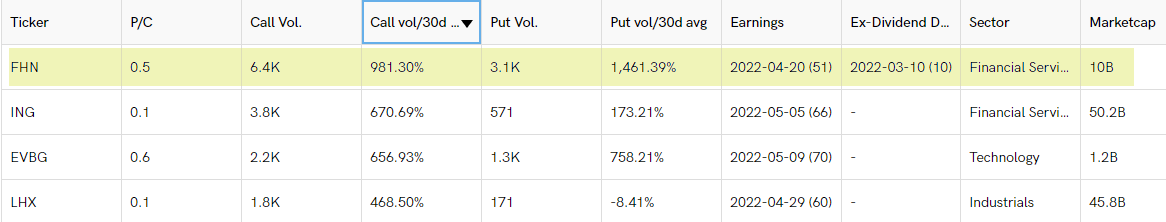

The call volume on First Horizon is now 981.30% greater than its 30-day call volume average; its put volume is 1,461.39% greater. In spite of the substantial increase on the put volume over its average, there have not yet been any singular or aggregated orders on puts that were markedly unusual or noteworthy as of this morning.

To view more information about FHN's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.