Unusual Options Activity in Pfizer Inc. (PFE) and Rolled Contracts on ZoomInfo Technologies Inc. (ZI)

Unusual Options Activity in Pfizer Inc. (PFE)

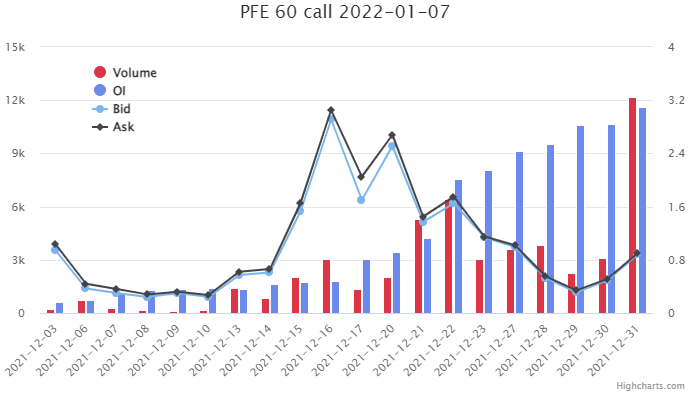

Today, December 31, 2021, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Pfizer Inc., which opened at $58.53.

- There were 1,541 contracts traded on the $60 strike call option dated for January 7th, 2021.

- The open interest on this chain was 11,600 as of this morning’s open, and with this new volume, the total volume on the chain has overtaken the open interest, 12,195 to 11,596, respectively.

- Additionally, the put-call ratio on Pfizer Inc.’s option order flow is at .6 which implies bullishness is increasing.

A tip from the flow: The put/call ratio (P/C) is put volume divided by call volume. Put/call ratio is important and can be an indication of sentiment shifting. A P/C greater than .7 means more puts are being bought than calls, so the trend is getting bearish. A P/C of .7 to .5 is becoming more bullish.

These orders come after the U.K. Approves Pfizer's Antiviral Covid-19 Pill 'Paxlovid'.

Historically, this chain had a spike in its spot price around December 16th and 17th, and today has reached its highest volumes and open interests thus far, with its bid-ask again beginning to climb.

To view more information about PFE's daily flow breakdown, click here to visit unusualwhales.com.

A Review of Unusual Options Activity in ZoomInfo Technologies Inc. (ZI)

Yesterday, December 30th, 2021, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw reports of unusual or noteworthy options trading volume and activity in ZoomInfo Technologies Inc. (ZI), which opened then at $64.86 and today at $64.43.

- There were 4,000 contracts traded on the $70 strike call option, dated for January 21st, 2022.

- Additionally, there were 2,500 contracts traded on the $65 strike call option, for the same date.

- Of note, the open interest on the $65 strike call was greater than the volume on this chain.

These were the orders that came in yesterday just before close (please note, the timestamps there were in a different time zone; that would have been around 03:50 p.m. EST).

As stated, on the $65 call option, the volume on the day was about the size of this order, but the open interest was around 3,800...so at that time, there was simply no way to know if they were bought or sold to open.

However, the $70 call option contracts were well above the 2,900 open interest, so we can be confident these were bought or sold to open.

A tip from the flow: Trades appended with 🛍️ can be intuited as bought or sold to open. This determination is made if the size of the trade was greater than the chain's open interest.

Only trades that can be positively identified as being bought or sold to open will be marked as such (with the 🛍️ symbol).

Be mindful! Trades without the 🛍️ symbol might still have been bought or sold to open!

As of today’s open, the open interest on the chain has increased by approximately 4,000 from yesterday, implying that the whale did, in fact, enter into the $70 strike call contracts to open.

As of today’s open, the open interest on the $65 strike chain decreased, implying that the whale exited those orders yesterday.

Altogether, therefore, this whale rolled their $65 strike option contracts up a strike and bought into more contracts, increasing the magnitude of this bet overall.

To view more information about ZI's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.