Unusual Options Activity in Preferred Apartment Communities, Inc. (APTS), Lucid Group, Inc. (LCID), and Fossil Group, Inc. (FOSL)

Unusual Options Activity in Preferred Apartment Communities, Inc. (APTS)

Today, February 07, 2022, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in APTS, which opened at $17.38.

- There were 4,610 contracts bought to open at the ask on the $20 strike call option dated for July 15th, 2022 at a spot price of $1.35 with a bid-ask spread of $1.10 to $1.35.

These orders come after Thomas Niel from InvestorPlace labeled APTS one of the “7 REITs With Major Upside Potential in 2022”.

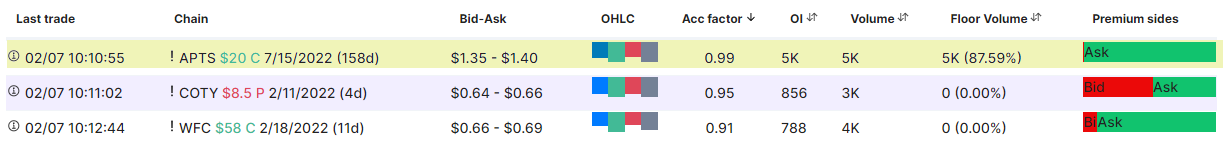

Of note, these orders were first found via the Unusual Whales Hottest Chains v2 page:

Of interest, these orders were marked as “floor”. Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag.

Click here to read about floor traders' performance.

To view more information about APTS's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Lucid Group, Inc. (LCID)

In the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity in Lucid Group, Inc. (LCID), which opened today at $27.61.

Two sets of 5,500 contracts came in at first, but were then canceled, and replaced with two separate orders of 4,702 and 4,701 contracts on the $18 strike put option dated for February 18th, 2022.

- The first set of 5,500 contracts came in at a spot price of $.06 and $.07, with a bid-ask spread of $.06 to $.07.

- The second set of 4,702 and 4,701 orders came in at the same spot prices, but the bid-ask had changed to $.07 to $.09.

- The open interest on this chain was 260 contracts held open this morning, and the volume on the chain is now approximately 14,800 contracts traded.

- Please note, trades that are struck through have been canceled for one reason or another. Trades can be modified or nullified for a variety of reasons, and per the SEC: for the maintenance of a fair and orderly market. Exchanges can erroneously send more trades than were actually placed, especially during times of high volume. This is a normal occurrence.

These orders come after Larry Ramer from InvestorPlace reported that “Risky Luxury EV Maker Lucid Still Faces an Array of Tough Challenges”.

47.90% of the premium traded at the $30,000 levels are in bullish bets, with five times as much put premium as call premium traded. Furthermore, the $5,000 premium levels are in bearish premiums at 60.53%, albeit with not as a divisive number of calls and puts traded. As can be seen, the overall options order flow on Lucid is bearish.

To view more information about LCID's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Fossil Group, Inc. (FOSL)

Finally, and again in the NasdaqGS, we saw unusual or noteworthy options trading volume and activity in Fossil Group, Inc. (FOSL), which opened today at $11.28.

- There were sweep-to-fill orders on the $14 strike call options dated for March 18th, 2022 bought to open at the ask at a spot price of $0.50 with a bid-ask spread of $0.35 to $0.50.

Additionally, these orders come after our previous reports on unusual options activity in Fossil Group.

65.3% of the premium traded is in bullish bets, with 65.3% of the premium traded is in calls, with 100% as ask-side orders. This makes perfect sense, given all of the calls traded on Fossil Group thus far today have been ask-side orders, constituting all of the bullish betting for the day.

The put call ratio for Fossil Group is 0.004, which is decisively bullish; however, this ticker is rather illiquid, especially for today, so while P/C is useful for a quick indication of sentiment, it is nearly impossible to determine without enough volume.

A tip from the flow: The put/call ratio (P/C) is put volume divided by call volume. Put/call ratio is important and can be an indication of sentiment shifting. A P/C greater than .7 means more puts are being bought than calls, so the trend is getting bearish. A P/C of .7 to .5 is becoming more bullish. (This distinction is made because more calls are often traded than puts, so a P/C of 1 is outside of the median.)

To view more information about FOSL's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.