Unusual Options Activity in QUALCOMM Incorporated (QCOM), RH (RH), and Expedia Group, Inc. (EXPE)

Unusual Options Activity in QUALCOMM Incorporated (QCOM)

Today, December 13, 2021, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today inn QUALCOMM Incorporated, which opened at $186.85.

- There were 157 contracts traded on the $200 strike call option, bought above the ask, on the April 14th, 2022 expiration.

- Additionally, there were 99 contracts traded on the $190 strike call option, traded again above the ask, for the January 20th, 2023 expiration.

- Of note, the volume on the $200 strike call options now have a greater volume than their open interest today, 805 to 652 respectively.

These orders come after Will Healy of The Motley Fool reported three reasons to buy QUALCOMM Incorporated at all time highs.

Friday, there was 2,449 open interest on this chain, and with open today 2,449 contracts remained.

Therefore, the 103 volume today could be considered to be opened or closed, which can be determined seeing open interest at tomorrow’s open; however, it must be stated again that all of the contracts reported above were opened above the ask, implying to open.

To view more information about QCOM's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in RH (RH)

Among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in RH (RH), which opened today at $602.75.

- There were a series of orders traded on both the $620 strike call options for January 21st, 2021.

- Of note, all of these orders were opened above the ask at $22.30, yet the bid-ask on these chains were $22.20 to $22.20 at the time of entry.

These orders come after Demitri Kalogeropoulos from The Motley Fool revealed important information from RH's previous earnings report.

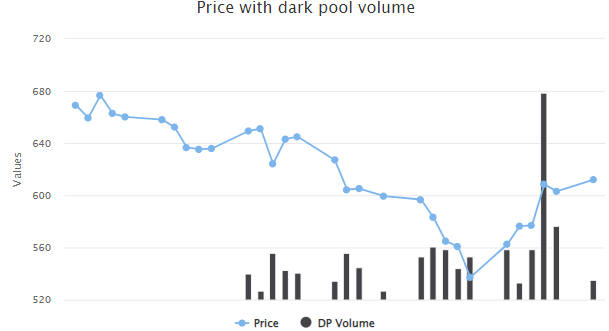

On December 9th, last Thursday, RH had a significant increase in dark pool activity, reaching 198,527 units traded. Friday, only 70,718 units were traded.

Thus far today, there have only been 19,155 units. The influx of dark pool activity was in line with RH’s price movement from $576.96 to $608.52 from Wednesday the 8th to Thursday the 9th.

To view more information about RH's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Expedia Group, Inc. (EXPE)

Finally, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in Expedia Group, Inc. (EXPE), which opened at $164.55.

- There were 2,400 contracts traded on the $170 strike call option, dated for February 18th, 2022, traded at the bid.

- Additionally, there were 4,000 contracts traded on the $170 strike call option for the June 17th, 2022 expiration, traded at the ask.

- Of note, the open interest of the June 17th chain is 59, and the open interest of the February chain is 4,100. It might be intuited, therefore, that these contracts were being closed on the earlier chain and rolled to the later dated one.

These orders come after The Motley Fool reported on more companies open their payment systems up to accepting crypto.

As seen, the original contracts were opened on December 6th, 2021, and as of the volume today, it might be concluded that those were sold to close today.

To view more information about EXPE's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.