Unusual Options Activity in Redwire Corporation (RDW), Atlassian Corporation (TEAM), and Meta Platforms, Inc. (FB)

Unusual Options Activity in Redwire Corporation (RDW)

Today, February 03, 2022, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Redwire, which opened at $5.43.

There were a series of orders on the $7.5 strike call options dated for March 18th, 2022, some at the ask, and some the bid, and some were even sweep-to-fill orders:

- The bid-ask spread on this chain at the time of these orders ranged from $0.35, the first entry spot price of the first transaction, and it has been as high as $0.65 thus far.

Of note, these orders were first found via the Unusual Whales Hottest Chains v2 page:

These orders come just after Kwhen Finance Editors reported “the stock is currently down 9.9% year-to-date, down 50.3% over the past 12 months, and down 50.3% over the past five years. This week, the Dow Jones Industrial Average fell 0.3%, and the S&P 500 rose 0.6%.”

As stated, some of these orders were marked as a “sweep”. An options sweep (or sweep-to-fill) occurs when a broker splits an order into many parts in order to get the best possible pricings currently offered on the market.

These orders can often be filled across multiple exchanges and the broker will continue to fill the order lot by lot, always for the best possible price, until the order is completely filled.

Sweeps might stand out because they imply some entity (or entities) wanted to enter specific options contracts regardless of their price, as they were focused only on having their entire bulk order filled as quickly as possible.

To view more information about RDW's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Atlassian Corporation (TEAM)

In the NasdaqGS, we saw unusual or noteworthy options trading volume and activity in Atlassian Corporation (TEAM), which opened today at $306.25.

The following cross trades came in together as 10,000 contracts traded on each chain:

- $310 strike call options dated for June 17th, 2022 bought to open at the ask of $42.03 with a bid-ask spread of $39.20 to $42.10. The open interest on this chain was approximately 46 contracts, so it can therefore be intuited that these contracts were either bought or sold to open, not closed.

- $320 strike call options dated for March 18th, 2022 traded at a spot price of $17.73 with a bid-ask spread of $17.70 to $19.50. The open interest on this chain was approximately 10K and the volume thus far on the chain is also approximately 10K, so it cannot be known whether these contracts were opened or closed as of this order.

- It might be interpreted that traders exited their March holdings and rolled them to a lower strike in June.

As stated, the orders in this report were cross trades: Cross trades occur when a broker executed buy and sell orders for this same position from different client accounts and then reported them on an exchange. In other words, these are an aggregation of many positions taken on both the buy and sell side.

These orders come after Jeremy Mullin from Zacks reported that Atlassian is a “Zacks Rank #5 (Strong Sell)”.

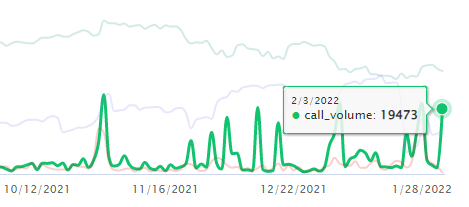

As of this writing, Atlassian has had 19,473 calls traded, which is 390% greater than its 30-day call average.

To view more information about TEAM's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Meta Platforms, Inc. (FB)

Finally, and again in the NasdaqGS, we saw unusual or noteworthy options trading volume and activity inMeta Platforms, Inc. (FB), which opened today at $244.65, having closed yesterday at $323.00.

With Facebook’s recent earnings report release, there has been significant and highly speculative betting this morning in the options market. Here are the biggest options trades thus far today:

Additionally, these orders come after Reuter’s reported the Nasdaq has dove more than 2%, as Facebook-owner Meta Platforms' dour forecast jolted the broader tech sector and threatened to upend a nascent recovery in stock markets..

Only 41.4% of the premium traded at these premium levels are in bullish bets, with 58% as ask-side orders, and 81% are in put premiums.

To view more information about FB's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.