Unusual Options Activity in Senseonics Holdings, Inc. (SENS), Accenture (ACN), and Alibaba Group Holding Limited (BABA)

Unusual Options Activity in Senseonics Holdings, Inc. (SENS)

Today, December 28, 2021, among the underlying components of the NYSE American, we saw unusual or noteworthy options trading volume and activity in Senseonics Holdings, Inc., which opened at $2.83.

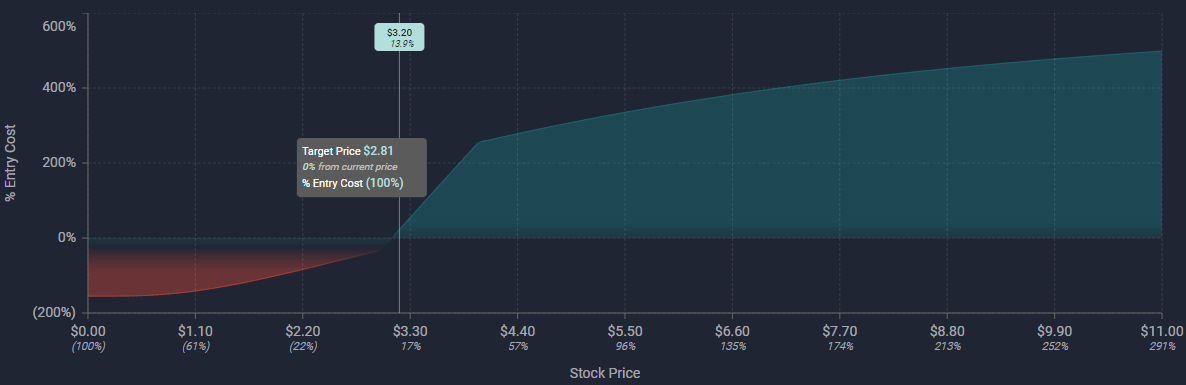

- There were 1,250 contracts traded on the $3 strike call option, dated for July 15th, 2022, bought to open at the ask.

- There were an additional 1,250 contracts traded on the $4 strike call option, for the same date, sold to open at the bid.

- Altogether, these orders represent a call debit spread, a bullish strategy with limited downside risk and upside gain.

A tip from the flow: trades appended with 🛍️ emoji can be intuited as bought or sold to open. Be mindful! Trades without the 🛍️ emoji might still have been bought or sold to open.

These orders come after Samuel Smith of TipRanks reported: “Senseonics Holdings: Analysts Expect 79% Upside Despite Unprofitability”

To view more information about SENS's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Accenture (ACN)

Again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Accenture (ACN), which opened today at $415.

- There were 1,000 contracts traded on the $430 strike call option and $430 strike put option, both dated for January 21st, 2022, sold to open at the bid and bought to open at the ask, respectively, representing a synthetic short position.

- Despite these orders coming in together as such, they were tagged as cross trades.

A cross trade occurs when a broker executed buy and sell orders for this same position from different client accounts and then reported them on an exchange. In other words, these are an aggregation of many positions taken, on both the buy and the sell side.

These orders come after Accenture “signed a 10-year collaborative agreement with Spanish multinational financial services company, Banco Bilbao Vizcaya Argentaria, S.A., popularly known as BBVA, to enhance their digital capabilities”.

58.6% of the premium traded at these premium levels are in bullish bets, with 58.6% as ask-side orders, and 100% are in call premiums.

To view more information about ACN's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Alibaba Group Holding Limited (BABA)

Finally and again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Alibaba Group Holding Limited (BABA), which opened today at $116.26.

- There were a series of high premium contracts that came through on the $115 strike and $100 strike call options, dated for January 21st and March 18th, 2022 respectively. They were sized in orders of 8,500, 5,000, and 2,500 trades.

- Be mindful: these orders were cross trades just as with the previously reported unusual activity.

These orders come after Alibaba Group Holding Limited “has been summoned by a consumer protection organization in China's Zhejiang Province, Reuters reported”.

85% of the premium traded at these premium levels are in bullish bets, with 73.2% as ask-side orders, and 63% are in call premiums.

To view more information about BABA's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.