Unusual Options Activity in Service Properties Trust (SVC), Ginkgo Bioworks Holdings, Inc. (DNA), and Oatly Group AB (OTLY)

A Review of Unusual Options Activity in Service Properties Trust (SVC)

Today, March 08, 2022, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options activity in Service Properties, which opened at $7.13.

- There were 2,000 contracts traded on the $10 strike call options dated for September 16th, 2022, traded at $0.50 with a bid-ask spread of $0.45 to $0.60.

- Furthermore, prior to that order, there were another 1,000 contracts as floor trades on the same strike and expiration, but for a spot price of $0.60.

- The open interest on this chain was approximately 1.1K as of the floor trade; the volume of 2,000 surpasses that, implying these orders were bought or sold to open, not closed.

Additionally, these orders come after BNKInvest reported that:

“In trading on Monday, shares of Service Properties Trust entered into oversold territory, hitting an RSI reading of 29.97, after changing hands as low as $7.105 per share.”

As of this writing, Service Properties has had 3,154 calls traded, which is 2,049% greater than its 30-day call average. Service Properties has a put/call ratio of 0.13, which is decisively bullish; however this company does not get enough options liquidity to see this as a true indication of sentiment.

A tip from the flow: The put/call ratio (P/C) is put volume divided by call volume. Put/call ratio is important and can be an indication of sentiment shifting. A P/C greater than .7 means more puts are being bought than calls, so the trend is getting bearish. A P/C of .7 to .5 is becoming more bullish.

To view more information about SVC's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Ginkgo Bioworks Holdings, Inc. (DNA)

Among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Ginkgo Bioworks Holdings, Inc. (DNA), which opened today at $3.43.

- There were 6,000 contracts traded on the $6 strike put option dated for March 18th, 2022, amounting to approximately $1.7M in premium traded.

- This chain had an open interest of approximately 17.1K, so it is impossible to know whether these orders were bought or sold to open.

- However, these orders were traded above the ask at a spot price of $2.90 with a bid-ask spread of $2.55 to $2.85, implying interest in entering the positions sooner than later.

- Be mindful, these orders come ahead of Ginkgo reporting its earnings on March 14th, 2022.

A tip from the flow: When viewing alerts in the Unusual Whales flow alerts page, you can click “Link to flow” to view chain’s activity in the overall options order flow, as seen here:

As can be seen, the original 6,000 contracts that came in were canceled and returned to the options order flow after, but at a new spot price of $2.85 from the original $2.60. The order was filled at the $2.85, which is still within the mid range of the bid-ask spread of $2.55 to $3.10.

Please note, trades that are struck through have been canceled for one reason or another. Trades can be modified or nullified for a variety of reasons, and per the SEC: for the maintenance of a fair and orderly market. Exchanges can erroneously send more trades than were actually placed, especially during times of high volume. This is a normal occurrence.

A tip from the flow: Trades appended with the ↕ and 🔃 emojis are trades that have potentially came in together as a part of a strategy, and are coded accordingly (such as MLET or TLCT) under the codes column. Clicking on these emojis will open all of the trades that came in together so that the holistic strategy may be investigated.

To view more information about DNA's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Oatly Group AB (OTLY)

Finally and again in the NasdaqGS, we saw unusual or noteworthy options trading volume and activity in Oatly Group AB (OTLY), which opened today at $5.75.

There were two sets of options contracts purchased on the April 14th, 2022 expirations:

- 10,000 contracts traded on the $5 strike call options at a spot of $1.15 with a bid-ask spread of $1.00 to $1.15.

- 20,000 contracts traded on the $7.5 strike call options at a spot of $0.30 with a bid-ask spread of $0.25 to $0.35.

- These chains’ open interests were 24 and 417 contracts; therefore, both of these orders were bought or sold to open, not to close.

- Be mindful, these orders come ahead of Oatly reportings its earnings on March 9th, 2022, before market open.

Of interest, these orders were marked as “floor”. Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag.

Click here to read about floor traders' performance.

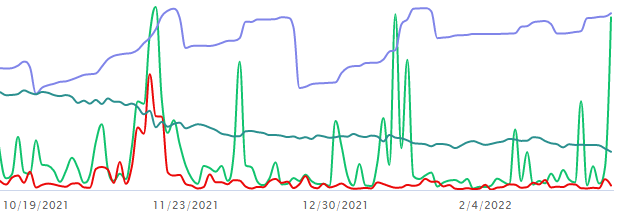

As seen, the contracts acceleration factor has decreased, implying there is lessening interest on these chains after these sizeable orders.

As of this writing, Oatly has had 30,916 calls traded, which is 1,031% greater than its 30-day call average.

To view more information about OTLY's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.