Unusual Options Activity in Stitch Fix, Inc. (SFIX), Apple Inc. (AAPL), and Arqit Quantum Inc. (ARQQ)

Unusual Options Activity in Stitch Fix, Inc. (SFIX)

Today, December 08, 2021, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today inn Stitch Fix, Inc., which opened at $18.13.

- There were 1,300 contracts traded above the ask on the $60 strike call option dated for January 19th, 2024.

- These contracts’ volumes were not greater than the chain’s open interest, so it cannot be ascertained whether these were to open or close, but, as stated, their spot price of $4 was above the bid-ask spread.

These orders come after Stitch Fix, Inc. released its financial results for the first quarter of fiscal year 2022 ended October 30, 2021.

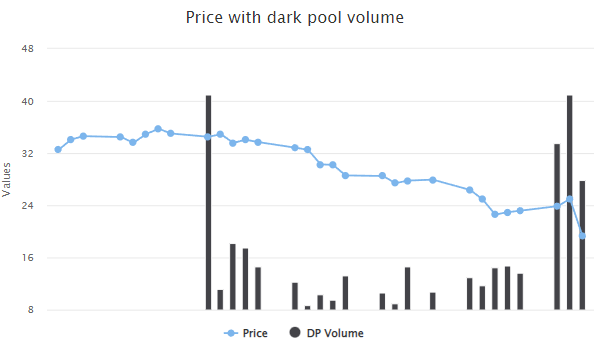

It was worth noting that surrounding $SFIX’s earnings report there was a significant increase in dark pool activity, even as its price began to come down.

To view more information about SFIX's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Apple Inc. (AAPL)

Again in the NasdaqGS, we saw unusual or noteworthy options trading volume and activity today in Apple Inc. (AAPL), which opened today at $172.12.

- There were two sets of orders, one set at 4,671 contracts traded and another at 4,954 contracts traded on the:

- The $185 strike call dated for December 23rd, traded once at the bid, then at the ask, as the bid-ask spread began to rise (to $0.83 - $0.84).

- And the $175 strike call for the same date, traded at the ask.

- All of these orders’ sizes (seen below) were greater than the chains’ open interests.

These orders come after Payal Gupta of TipRanks reported that Apple Inc.:

“secretly signed an agreement worth more than $275 billion with Chinese officials. Citing a report on The Information, Reuters reports the deal has gone on to protect the iPhone maker from threats and regulatory crackdowns in one of its most important markets. AAPL shares rose 3.54% to close at $171.18 on December 7.”.

As of this writing, Apple Inc. has had 907,287 calls traded, which is 110% greater than its 30-day call average, which could be considered within a relative mean of change in speculation over time on a megacap.

Note well, the significant decrease in volume seen today is due to this report being written in the morning.

To view more information about AAPL's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Arqit Quantum Inc. (ARQQ)

Finally, in the Nasdaq Capital Market (NasdaqCM), we saw unusual or noteworthy options trading volume and activity in Arqit Quantum Inc. (ARQQ), which opened at $23.94.

As we know, somebody always knows. Unusual Whales blog we have previously reported on such deep in the money call buying.

Below, as seen, there has been more significant, regular deep in the money call purchases being made, and potentially exercised during the day, in Arqit Quantum Inc...

These orders come after

“Arqit Quantum Inc. (“Arqit”) and NEOM Tech and Digital Company (via its affiliate, NEOM Company) have entered a Memorandum of Understanding (MOU) today to build and trial the ‘Cognitive City’ quantum security system”.

89.3% of the premium traded at these premium levels are in bullish bets, with 35.7% as ask-side orders, and 25% are in call premiums.

To view more information about ARQQ's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.