Unusual Options Activity in Taiwan Semiconductor Manufacturing Company Limited (TSM) , Phunware, Inc. (PHUN), and Vale S.A. (VALE)

Unusual Options Activity in Taiwan Semiconductor Manufacturing Company Limited (TSM)

Today, January 13, 2022, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Taiwan Semiconductor, which opened at $140.75.

- There were multiple sets of 2,000 and 1,800 sized contracts traded on the $155 strike call option, dated for January 28th, 2022, bought to open at the ask.

- These contracts were likely a trade previously reported from a user on Twitter, and now this trade has sold to close the $140 strike calls dated for the 21st, and have rolled them to higher strikes and further out dates.

Check out the one and only Snorlax in this explanation! In this video, he explains how to track these kinds of opportunities in the Unusual Whales flow.

These orders come after MTNewswires reported that Taiwan Semiconductor “rose 5% after reporting Q4 earnings of NT$32.05 ($1.15) per American depositary share”.

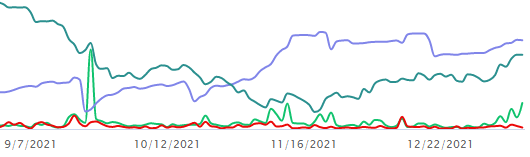

As can be seen, the volume on this chain overshadows the open interest (which is hardly viewable given the scale of these orders), so therefore we know these contracts were, indeed, bought or sold to open, not closed.

To view more information about TSM's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Phunware, Inc. (PHUN)

In the Nasdaq Capital Market (NasdaqCM), we saw unusual or noteworthy options trading volume and activity in Phunware, Inc. (PHUN), which opened today at $3.05.

- There were 1,999 contracts traded on the $3 strike put call option, dated for January 21st, 2022, bought to open at the ask. The bid-ask spread on this chain was $.35 to $.40 at the time of entry, and the spot price was $.40.

If you would like to read more about this new panel, please check this Twitter thread here.

These orders have come after Kwhen Finance Editors reported: “shares closed [on the 10th] 13.4% lower than it did at the end of [the 9th].”

A tip from the flow: Trades appended with a briefcase emoji can be intuited as bought or sold to open. This determination is made if the size of the trade was greater than the chain's open interest. Only trades that can be positively identified as being bought or sold to open will be marked as such (with the briefcase).

Be mindful! Trades without the briefcase emoji might still have been bought or sold to open!

67.8% of the premium traded at these premium levels are in bearish bets, with 77.4% as ask-side orders, and 63.3% are in put premiums.

To view more information about PHUN's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Vale S.A. (VALE)

Finally, and again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Vale S.A. (VALE), which opened today at $15.36.

- There were a series of cross trades at the $16 and $18 strike call options, dated for February 18th, 2022, bought to open at the ask.

- Additionally, there were another series of cross trades for January 21st, the $14 and $17 strike call options, also bought to open at the ask.

- Be mindful: both the $18 strike and $17 strike call options had lower premium bid-ask spread, and the $18 strike was traded at the mid price of $.12 with a bid-ask of $.11 to $.13.

These orders come after Stavros Georgiadis from TipRanks reported that Vale,

“Despite Drop, Strong Fundamentals Supportive in 2022”.

As of this writing, Vale has had 154,630 calls traded, which is 498% greater than its 30-day call average.

To view more information about VALE's flow breakdown, click here to visit unusualwhales.com.

As stated, the orders in this report were cross trades.

Cross Trades

A cross trade occurs when a broker executed buy and sell orders for this same position from different client accounts and then reported them on an exchange.

In other words, these are an aggregation of many positions taken on both the buy and sell side.

There is currently no Unusual Whales' research into cross trades. The below is therefore speculative:

"Painting the Tape"

There are growing concerns that cross trades can be used to "paint the tape", where market makers/traders who are trying to influence momentum trade on preset prices amongst themselves, sometimes even taking minor losses, in order to create artificial price action just to give the appearance of inclement trading activity.

This can cause retail traders to jump in on cross traders, thereby causing other market makers to have to take on those orders, hedging their deltas and gammas appropriately... Once the momentum is up, the original traders can exercise, causing no additional volume on the day.

Key Takeaways

Those watching the options order flow won't even be aware of the exits on some cross trades and if they followed will not be able to see whales' movements by following order flow.

Be mindful! As stated, there is currently no research to prove the above, and as cross trades are an amalgamation of orders, it is best to consider them as neutral volume without direction.

Have you read the the Unusual Whales Congressional Trading in 2021 Report yet?

Here is the TL;DR:

- Hundreds of millions of dollars have been exchanged on the stock market by our elected officials in 2021 alone

- In just equities, Congress bought and sold nearly $290 million throughout the year.

- In 2021, Congress beat the market!

- This report shows which sectors were preferred by each party and branch, oftentimes huge trade amounts could be attributed to one or two members.

- Big legislative events (such as the Infrastructure Bill getting passed by the Senate) were often preceded by politicians trading in the sectors affected. There were tons of unusual trades where politicians made millions of dollars.

- Congress has 45 days to disclose trades to the public, sometimes they are late and you can see a list of late disclosures here!

- Some politicians held securities in the sectors they vocally expressed support for (such as Senators holding cryptocurrencies while drafting crypto regulations).

- The report highlights many of these and other unusual instances!

Go check out the full report here, and you are encouraged to read through and share your thoughts on Twitter and the Discord community.