Unusual Options Activity in Teck Resources Limited (TECK), Vale S.A. (VALE), and B&G Foods, Inc. (BGS)

Today, March 01, 2022, we saw unusual options trading activity in Teck Resources Limited (TECK), Vale S.A. (VALE), and B&G Foods, Inc. (BGS); these come after Vale’s earnings report from February 28th, 2022 and just ahead of B&G Foods reporting its earnings today after market close.

A Review of Unusual Options Activity in Teck Resources Limited (TECK)

Today, March 01, 2022, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Teck, which opened at $36.10.

- There were 1,147 contracts traded on the $37 strike call option dated for March 4th, 2022, traded near the ask at a spot of $1.10 with a bid-ask spread of $0.95 to $1.16. These contracts are currently in the money, with Teck having opened at and currently trading around $36.10.

- The open interest on this chain was 123 as of this morning’s open, so therefore we can intuit these as having been bought or sold to open, as there was no open interest available to have been closed in these orders.

Please note, Teck does not go ex-div until March 14th, 2022, so it is not anticipated these trades are a part of capturing dividends.

However, these orders do come after Teck’s most recent earnings report, in which:

This quarterly report represents an earnings surprise of -0.98%. A quarter ago, it was expected that this company would post earnings of $1.07 per share when it actually produced earnings of $1.49, delivering a surprise of 39.25%.

A tip from the flow: Trades appended with a briefcase emoji can be intuited as bought or sold to open. This determination is made if the size of the trade was greater than the chain's open interest. Only trades that can be positively identified as being bought or sold to open will be marked as such (with the briefcase).

To view more information about TECK's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Vale S.A. (VALE)

Today, March 01, 2022, again in the NYSE, we saw unusual activity in Vale S.A. (VALE), which opened today at $18.56.

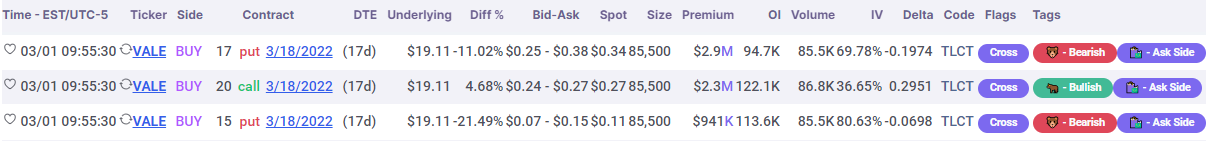

There were a series of cross trades of 85,500 contracts on the March 18th, 2022 expirations for the following option contracts:

- The $17 strike put options traded at $0.34 with a bid-ask spread of $0.25 to $0.38.

- The $20 strike call options traded at $0.27 with a bid-ask spread of $0.24 to $0.27.

- The $15 strike put options traded at $0.11 with a bid-ask spread of $0.07 to $0.15.

- Furthermore, these orders come after Vale’s earnings report from February 28th, 2022:

Vale’s adjusted earnings per share in 2021 was $5.40, beating the Zacks Consensus Estimate of $4.16. Including one-time items, earnings was $4.47 in 2021 compared with 95 cents in 2020. Sales surged 38% year over year to $54.5 billion, which surpassed the Zacks Consensus Estimate of $54.1 billion.

As stated, the orders in this report were cross trades: Cross trades occur when a broker executed buy and sell orders for this same position from different client accounts and then reported them on an exchange. In other words, these are an aggregation of many positions taken on both the buy and sell side.

Furthermore, as these have come just after the reported earnings, it may be intuited this dramatic volume is merely institutional repositioning. Emergent volume need not always be interpreted as a buying or selling opportunity.

A tip from the flow: Trades appended with the ↕ and 🔃 emojis are trades that have potentially came in together as a part of a strategy, and are coded accordingly (such as MLET or TLCT) under the codes column. Clicking on these emojis will open all of the trades that came in together so that the holistic strategy may be investigated.

The put volume on Vale is now 985.36% greater than its 30-day put volume average; its call volume is 120.16% greater.

To view more information about VALE's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in B&G Foods, Inc. (BGS)

Finally, and again in the NYSE, we saw unusual or noteworthy options trading volume and activity in B&G Foods, Inc. (BGS), which opened today at $29.50.

- There were 3,978 contracts traded on the $25 strike put option traded at a spot price of $0.55 with a bid-ask spread of $0 to $2.60, implying extraordinary illiquidity on this chain.

Additionally, these orders come just ahead of B&G Foods reporting its earnings today, March 1st, 2022, after market close.

Of interest, these orders were marked as “floor”. Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag.

Click here to read about floor traders' performance.

As seen, these are the $25 strike put options which are at -.18 delta, and at the standard deviation from the expected move after the earnings report. The IV on this chain is 44.2%.

To view more information about BGS's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.