Unusual Options Activity in Teladoc Health, Inc. (TDOC), FuelCell Energy, Inc. (FCEL), and Salesforce.com, Inc. (CRM)

Unusual Options Activity in Teladoc Health, Inc. (TDOC)

Today, December 29, 2021, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Teladoc Health, Inc., which opened at $91.00.

- There were 829 contracts on the $85 and $95 strike put option dated for December 31st, 2021 and January 7th, 2022.

- As these contracts were bought and sold at similar sizes for differing expirations, these could have been a part of an overall strategy, such as a calendar spread; however, the volumes compared to the open interests reveals that these sets of contracts were likely being rolled to a later date.

These orders come after Trevor Jennewine of The Motley Fool reported:

“Barclays currently has a price target of $345 on Upstart Holdings (NASDAQ: UPST), implying 116% upside. And RBC Capital has a price target of $215 on Teladoc Health (NYSE: TDOC), implying 130% upside”.

As can be seen, on the 23rd, 2,245 contracts were opened on this chain, and today’s open interest was 2,106 contracts in circulation, of which 2,112 volume has now been transacted, implying these contracts were closed today.

As seen, the volume is well above the open interest, 1,966 contracts now traded against 109 in circulation as of yesterday’s close. Again, it may therefore be intuited these contracts were opened, not closed, but could have been sold to open, potentially as part of a spread (click here to read more about those possibilities).

To view more information about TDOC's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in FuelCell Energy, Inc. (FCEL)

In the Nasdaq Global Market Composite (NasdaqGM), we saw unusual or noteworthy options trading volume and activity in FuelCell Energy, Inc. (FCEL), which opened today at $5.13.

- There were 16,939 contracts traded on the $4.5 strike put option, dated for January 21st, 2022, bought to open at the ask.

- There were floor trades. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag.

- Here is a snippet of an Unusual Whales’ report on floor traders’ performance:

More interestingly, we found that floor traders do not bet on crazy far OTM calls. Instead, most of the purchased weekly calls are ~10% ITM, with about a 40% chance to turn a profit. And when it comes to OTM calls, nearly half of these trades end up making gains and roughly a third of them can hit 50% and above.

These orders come after FuelCell Energy, Inc. “on Wednesday posted a loss for the fourth quarter, reflecting higher expenses.”

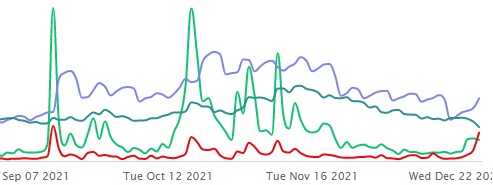

As of this writing, FuelCell Energy, Inc. has had 84,675 puts traded, which is 179% greater than its 30-day put average.

To view more information about FCEL's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Salesforce.com, Inc. (CRM)

Finally and again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Salesforce.com, Inc. (CRM), which opened today at $256.00.

- There were 1,498 contracts traded on both the $255 strike and $257.5 strike call options, dated for December 31st, 2021.

- Of note, the $257.5 strike position had approximately 2,000 open interest as of this morning’s open, so this volume cannot ascertain whether these positions were closed or opened.

- However, the $255 strike position had a greater size than open interest, so those calls were opened, but it cannot be established whether they were bought or sold to open from volume over open interest alone.

These orders come after Simply Wall St posited that while Salesforce.com, Inc...

“Has Shown Weakness Lately But Financial Prospects Look Decent: Is The Market Wrong?”

30.4% of the premium traded at these premium levels are in bullish bets, with 34.3% as ask-side orders, and 96.1% are in call premiums.

To view more information about CRM's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.