Unusual Options Activity in Tenaris S.A. (TS), Occidental Petroleum Corporation (OXY), and JD.com, Inc. (JD)

A Review of Unusual Options Activity in Tenaris S.A. (TS)

Today, March 07, 2022, among the underlying components of NYSE, we saw unusual and noteworthy options trading volume on Tenaris, which opened at $27.49.

- There were a series of orders on the $27.5 strike call options dated for March 18th, 2022 traded at the ask with a bid-ask spread of $0.65 to $1.30.

- The open interest on this chain is 262, so the current volume of 678 implies that these traders are opening positions, not closing them.

Additionally, these orders come after Zack’s labeled Tenaris as one of the “Best Momentum Stocks to Buy for February 23rd”.

These orders were found via the NEW Unusual Whales tickers flow tool; as seen, the call volume on Tenaris is now 1,089.66% greater than its 30 day call volume average.

A tip from the flow: When viewing alerts in the Unusual Whales flow, you can click the order’s option contract expiration to open another panel which has three additional charts and a table to take a deeper dive into the company’s overall intraday options volumes, the chain’s bid-ask pressures, and historical volumes and open interests.

As seen, the volume has now far exceeded the open interest on this chain, so it may be intuited these traders are opening positions, not closing them.

To view more information about TS's daily flow breakdown, click here to visit unusualwhales.com.

,

Again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Occidental Petroleum Corporation (OXY), which opened today at $57.71.

There were two sets of 9,742 contracts traded on April 14th, 2022, expirations:

- $60 strike call options bought to open at the ask with a spot price of $5.05 with a bid-ask spread of $4.95 to $5.10. This chain had approximately 4K open interest as of this morning’s open, and the overall volume on the chain is approximately 12K, implying these were indeed to open.

- $50 strike call options traded at the bid with a spot price of $9.9 with a bid-ask spread of $9.9 to $10.00. This chain, unlike the previous, had an open interest of approximately 12K and approximately 10K volume, so it cannot be stated as a matter of fact as to whether these were opened or closed.

- It is expected, however, these $50 strike calls are being sold to close and rolled up to the $60 strike call options.

- Additionally, these orders come just after “Warren Buffett's Berkshire Hathaway Inc BRKa.N revealed a more than $5 billion stake in Occidental Petroleum Corp OXY.N, as oil prices soared to their highest level in about a decade”.

A tip from the flow: Trades appended with the ↕ and 🔃 emojis are trades that have potentially came in together as a part of a strategy, and are coded accordingly (such as MLET or TLCT) under the codes column. Clicking on these emojis will open all of the trades that came in together so that the holistic strategy may be investigated.

As the historical volume on the $50 strike chain mostly came in on March 1st, 2022, in the amount of 15,827 volume, it is intuited that this trader is now taking profits on these positions and rolling them higher.

If these orders were in fact together, they could be intuited as a call credit spread, in which the trader is collecting credit to sell call options… This is assumed to not be the case, however, especially given where Occidental Petroleum is currently trading.

The underlying price is trading at or around $56.75, therefore these contracts may instead be interpreted as rolls, in which the trader is selling to close the $50 strike calls and rolling them up to the $60 strikes.

To view more information about OXY's flow breakdown, click here to visit unusualwhales.com.

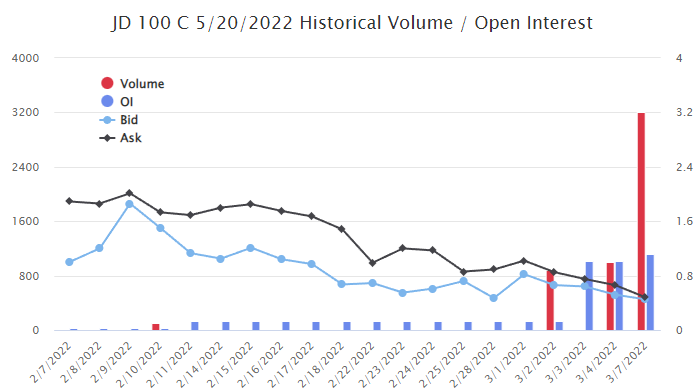

Unusual Options Activity in JD.com, Inc. (JD)

In the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity in JD.com, Inc. (JD), which opened today at $63.20.

- There were a series of orders on the $100 strike call options dated for May 20th, 2022 bought to open at the ask of a spot price of $0.48 with a bid-ask spread of $0.45 to $0.48.

- The open interest on this chain was approximately 1.1K and the volume thus far has been approximately 3.5K.

- These orders come just ahead of Tenaris reporting its earnings March 10th, 2022 before market open.

A tip from the flow: The ! emoji means the volume of the chain is greater than the open interest on the chain itself.

As seen, the contracts had an acceleration factor of 1, implying there was a rapid increase in trading activity over open interest on this chain.

As seen, the volume has now far exceeded the open interest on this chain, so it may be intuited these traders are opening positions, not closing them.

To view more information about JD's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.