Unusual Options Activity in Teucrium Corn Fund (CORN), Ares Capital Corporation (ARCC), and Uber Technologies, Inc. (UBER)

A Review of Unusual Options Activity in Teucrium Corn Fund (CORN)

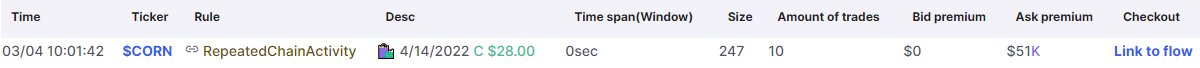

Today, March 04, 2022, among the underlying components of NYSEArca, we saw unusual and noteworthy options trading volume on Teucrium Corn Fund, which opened at $26.68.

- There were a series of repeated options activity from separate orders of various sizes on the $28 strike call option dated for April 14th, 2022, traded at the ask of $2.05 with a bid-ask spread of $1.90 to $2.05.

- The open interest on this chain is 702; the total volume thus far today is 722. Therefore, it must be stated that these orders could potentially be closing positions, even at the ask.

- Additionally, these orders come as the Ukraine-Russia war saga continues driving commodity prices.

A tip from the flow: When viewing alerts in the Unusual Whales flow alerts page, you can click “Link to flow” to view chain’s activity in the overall options order flow, as seen here:

A tip from the flow: When viewing alerts in the Unusual Whales flow, you can click the order’s option contract expiration to open another panel which has three additional charts and a table to take a deeper dive into the company’s overall intraday options volumes, the chain’s bid-ask pressures, and historical volumes and open interests.

As seen, the open interest and volume are almost identical; therefore, there cannot be a determination as to whether these contracts were opened or closed. Always be mindful that active or emergent volume is not indicative of direction!

To view more information about CORN's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Ares Capital Corporation (ARCC)

In the Nasdaq Global Market Composite (NasdaqGM), we saw unusual or noteworthy options trading volume and activity in Ares Capital Corporation (ARCC), which opened today at $22.12.

- There were 9,205 contracts traded on the $20 strike put option dated for April 14th, 2022, bought to open at the ask at a spot price of $0.30 with a bid-ask spread of $0.00 to $0.35, implying illiquidity in the chain, given an unusual and wide bid-ask spread.

- However, the open interest on this chain was only 2,038 contracts as of today’s open, with the chain’s volume now surpassing 10,248, which is noteworthy.

These orders come after Ares Capital posted a fourth-quarter 2021 net investment income of 52 cents per share.

As seen, the contracts had an acceleration factor of 0.98, implying there was a rapid increase in trading activity over open interest on this chain.

This chain began seeing noteworthy activity on the 25th in the amount of 2,233 contracts traded which carried over as open interest into today.

Therefore, we may intuit that this is either a continuation of that trend, or that more traders are opening positions today than closing, and whether or not they are trading them intraday may be determined by looking at the chain’s open interest as of Monday morning’s market open.

To view more information about ARCC's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Uber Technologies, Inc. (UBER)

Finally, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Uber Technologies, Inc. (UBER), which opened today at $31.50.

- There were 13,000 contracts traded on the $30 strike call option dated for April 14th, 2022 bought to open at the ask at a spot price of $2.42 with a bid-ask spread of $2.37 to $2.43.

- The open interest on this chain was 4,486 contracts and the overall volume is now 16,677 as of this writing.

A tip from the flow: Trades appended with the ↕ and 🔃 emojis are trades that have potentially came in together as a part of a strategy, and are coded accordingly (such as MLET or TLCT) under the codes column. Clicking on these emojis will open all of the trades that came in together so that the holistic strategy may be investigated.

- Alongside the aforementioned $30 strike calls were $32.5 strike calls for the same date, also with 13,000 contracts traded, but traded at the bid of $1.41 with a bid-ask spread of $1.43 to $1.44.

- However, the open interest on this chain was approximately 16K, and the overall volume thus far today is also 16K, so it cannot be determined if these contracts were opened or closed, or used with the put as a part of a multileg strategy.

Furthermore, these orders come after Adam Levy from The Motley Fool reported that: "Uber's Showing Ambitions Beyond Rides and Delivery".

Of interest, these orders were marked as “floor”. Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag. Click here to read about floor traders' performance.

To view more information about UBER's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.