Unusual Options Activity in The Charles Schwab Corporation (SCHW), Endeavor Group Holdings, Inc. (EDR), and Freeport-McMoRan Inc. (FCX)

Unusual Options Activity in The Charles Schwab Corporation (SCHW)

Today, October 26, 2021, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in The Charles Schwab Corporation, which opened at $83.49.

There were 500 contracts traded on the $90 strike call option, bought to open at the ask, dated for November 19th, 2021, representing approximately 50,000 shares and $19,000 premium traded.

These orders are particularly noteworthy not only as they are floor trades above the existing open interest on the chain, but also because they come in after reports that The Charles Schwab Corporation’s founder and chairman, Charles R. Schwab, recently sold a substantial US$15m worth of stock at a price of US$81.18 per share.

Furthermore, reported yesterday on the Unusual Whales News Flow, Bernard J. Clark and Joseph R. Martinetto also sold shares at $84 and $83.99 respectively.

Bullish premium leads with 69.6% of the flow, with 87.7% in call premium traded with 79.4% as ask-side orders.

To view more information about SCHW's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Endeavor Group Holdings, Inc. (EDR)

Again, in the NYSE, we saw unusual or noteworthy options trading volume and activity today in Endeavor Group Holdings, Inc. (EDR), which opened at $24.81.

- There were 5,000 contracts traded on the $30 strike call option, sold at the bid, dated for November 19th, 2021.

- Additionally, there were another 5,000 contracts traded on the $25 strike call option, also at the bid, and for the same date.

- Finally, there were 5,000 contracts traded on the $22.5 strike put option, again sold at the bid, for the same date.

Altogether, this strategy represents a ratio strangle, approximately 1,500,000 shares and $1,325,000 in premium traded.

These orders come in after BNK Invest’s report on Endeavor Group Holdings, Inc., revealing that it has traded at a recent price of $24.27/share, the average analyst target is 40.55% higher at $34.11/share.

As seen, this strategy has an unlimited risk to the up and downsides, at approximately $18.95 and $28.55 respectively.

To view more information about EDR's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Freeport-McMoRan Inc. (FCX)

Finally, and yet again among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Freeport-McMoRan Inc. (FCX), which opened at $39.44.

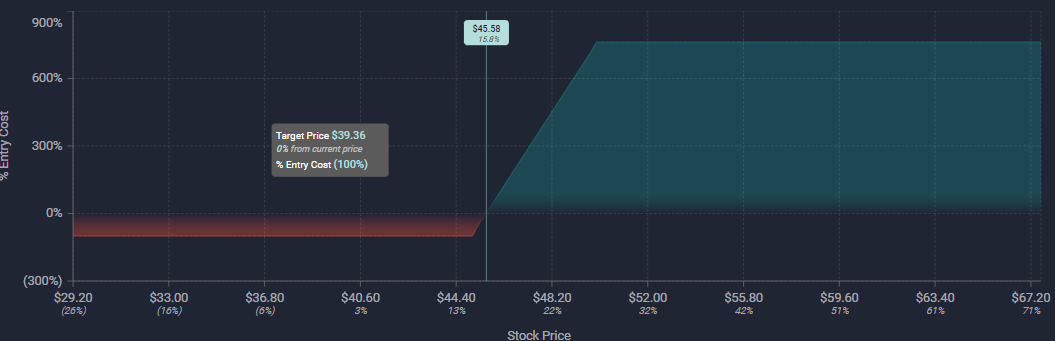

- There were 5,500 contracts traded on the $45 strike call option, bought to open at the ask, dated for December 17th, 2021.

- Additionally, there were another 5,500 contracts traded on the $50 strike call option, sold to open at the bid, for the same date.

Altogether, these contracts, if they were opened together, represent a call debit spread, 1,100,000 shares, and $677,000 in premium traded.

These orders come after reports where Simply Wall St stated that Freeport-McMoRan Inc. can provide an excellent opportunity to hedge against inflation while earning a dividend yield.

Bullish premium accounts for 79.8% of options flow data at these levels, with 85.1% in ask-side orders, of which 94.7% are in call contracts.

As seen, this strategy has a limited downside risk and a limited upside potential, with maximum profit being obtained at a price of $50 at the strategy’s expiration.

To view more information about FCX's flow breakdown, click here to visit unusualwhales.com.