Unusual Options Activity The Cheesecake Factory Incorporated (CAKE), Vodafone Group Plc (VOD), Altice USA, Inc. (ATUS)

Unusual Options Activity in The Cheesecake Factory Incorporated (CAKE)

Today, October 21, 2021, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity in The Cheesecake Factory Incorporated, which opened at $41.15.

There were 3,000 contracts traded on the $35 strike put option, at the ask, dated for November 19th, 2021.

Additionally, there were another 1,500 contracts traded on the $40 strike put option, also at the ask, for the same date.

Altogether, these contracts represent approximately 450,000 shares and $450,000 premium traded.

These orders come after Simply Wall St’s reports that The Cheesecake Factory Incorporated’s valuation model shows that the intrinsic value for the stock is $66.94.

As of this writing, CAKE’s open interest is 20,328 as of yesterday’s close; this is down from 32,561 open interest on Friday, October 15th, 2021. In spite of this, put volume has increased today to 4,576 from 620 on the 15th.

To view more information about CAKE's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Vodafone Group Plc (VOD)

Again, in the NasdaqGS, we saw unusual or noteworthy options trading volume and activity today in Vodafone Group Plc (VOD), which opened at $15.55.

There were 48,227 contracts traded at the ask on the $17 strike call option dated for April 14th, 2022.

This order represents approximately 4,822,700 shares and $2,400,000 premium traded.

These orders come in after reports revealing that Vodafone Group Plc said it would add nearly 7,000 software engineers to its workforce by 2025 to develop more of its own digital services across Europe and Africa.

As of this writing, VOD has had 108,443 calls traded, which is approximately 6,765% above its 30-day call volume average.

To view more information about VOD's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Altice USA, Inc. (ATUS)

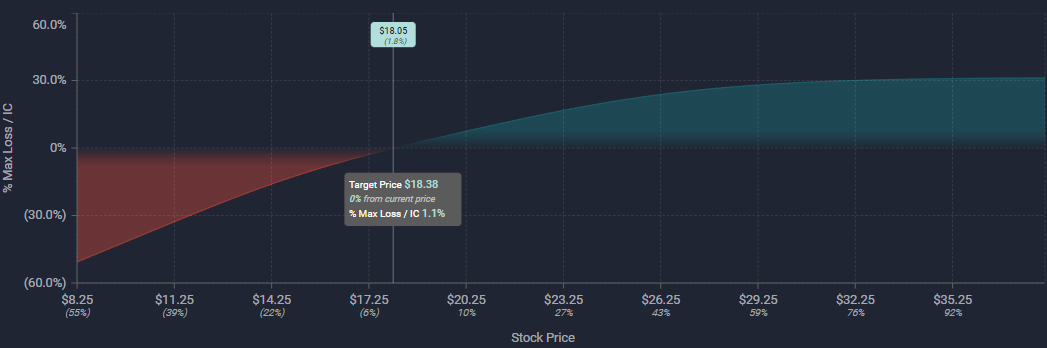

Finally, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Altice USA, Inc. (ATUS), which opened at $18.52.

There were 4,988 contracts traded on the $20 strike call option, at the ask, dated for December 17th, 2021.

There were an additional 4,988 contracts traded on the $25 strike call option, at the bid, for the same date, representing a call debit spread.

Finally, there were another set of 4,988 contracts traded on the $17 strike put option, at the bid, again for the same date.

These orders come after reports by MTNewswires revealing that ViacomCBS (VIAC) had renewed its distribution agreement with Altice USA (ATUS), with the deal also including ViacomCBS' Paramount+, Showtime OTT, and Pluto streaming services for customers on Altice USA's Optimum and Suddenlink platforms.

As seen, this is a bullish strategy with a limited upside, due to the selling of the $25 strike call contracts, and an infinite downside, due to the selling of the $17 strike put contracts.

To view more information about ATUS's flow breakdown, click here to visit unusualwhales.com.