Unusual Options Activity in Twitter, Inc. (TWTR), Ford Motor Company (F), and Bakkt Holdings, Inc. (BKKT)

Unusual Options Activity in Twitter, Inc. (TWTR)

Today, November 24, 2021, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Twitter, Inc., which opened at $46.66.

- The unusual activity came in as 2,941 contracts on the $55 strike call options, above the ask, dated for February 18th, 2022. The contracts were filled at $1.78 with a bid-ask of $1.66-$1.76.

- These contracts altogether represent approximately 294,100 shares and $523,000 in premium traded.

These orders come after BNK Invest reported that Twitter, Inc., in trading on Thursday, [...] entered into oversold territory, hitting an RSI reading of 28.9, after changing hands as low as $48.46 per share..

88.4% of the premium traded at these premium levels are in bullish bets, with 88.4% as ask-side orders, and 100% are in call premiums.

To view more information about TWTR's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Ford Motor Company (F)

Again in the NYSE, we saw unusual or noteworthy options trading volume and activity today in Ford Motor Company (F), which opened today at $19.97.

- There were 22,500 contracts traded on the $28, $27, $22, and $20 strike call options, all dated for January 21st, 2022, and sold at the bid.

- These contracts represent approximately 3,150,000 shares and $4,300,000 in premium traded.

- Of note, only the $28 strike call option had volume above its open interest, and it was sold below the bid at $0.11, with a bid-ask spread of $0.12-$0.13.

- It could therefore be assumed these positions are being closed, not sold to open, but that will be apparent at Friday’s open, taking a look at the chains’ open interests again.

As Mr. Jim Cramer has been discussing Ford consistently as of late, we have investigated Cramer’s ability to move the prices of his favorite tickers. In fact, we have found that:

Cramer’s show had a detectable impact on stock daily returns. More interestingly, we found the once lauded phenomenon known as the “Cramer Bounce” seems to now be a “Cramer Dive”."

Click the above to read more about our findings on Cramer’s career as a media personality and his impact on stocks.

As seen, the volume today is not enough to account for the chain itself, so it may be presumed this trader has closed these positions, and that Friday’s open interest will have decreased by the requisite 22,500 contracts from this order.

To view more information about F's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Bakkt Holdings, Inc. (BKKT)

Finally, and again in the NYSE, we saw unusual or noteworthy options trading volume and activity today in Bakkt Holdings, Inc. (BKKT), which opened at $16.74.

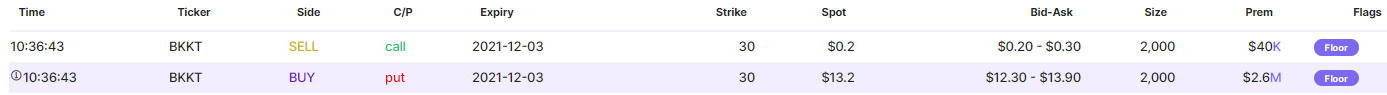

- There were 2,000 contracts traded on the $30 strike call option, at the bid, dated for December 3rd, 2021.

- There were an additional 2,000 contracts traded on the $30 strike put option, at the ask, and for the same date.

- If these orders were both opened, then altogether, they represent a synthetic short, approximately 400,000 shares and $2,640,000 in premium traded.

Earlier this month, regarding Bakkt Holdings, Inc., we asked the question:

“Why are deep in the money call contracts being bought to open by floor traders in Bakkt Holdings, Inc.?”

Click above to read our full report into the history of Bakkt and its unusual trading.

To view more information about BKKT's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.