Unusual Options Activity in Under Armour, Inc. (UAA), Suncor Energy Inc. (SU), and Texas Roadhouse, Inc. (TXRH)

Unusual Options Activity in Under Armour, Inc. (UAA)

Today, October 29, 2021, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Under Armour, Inc., which opened at $22.04.

There were 15,000 contracts traded on the $60 strike call option, sold to close at the bid, dated for October 29th, 2021.

Additionally, there were 8,500 contracts traded on the $25 strike call option, bought to open at the ask, dated for November 5th, 2021.

Finally, there were another 7,000 contracts traded on the $26 strike call option, sold to open at the bid, for the same date.

Altogether, these contracts represent approximately 1,550,000 shares and $294,000 in premium traded.

Note well, Under Armour, Inc. reports its earnings on November 2nd, 2021.

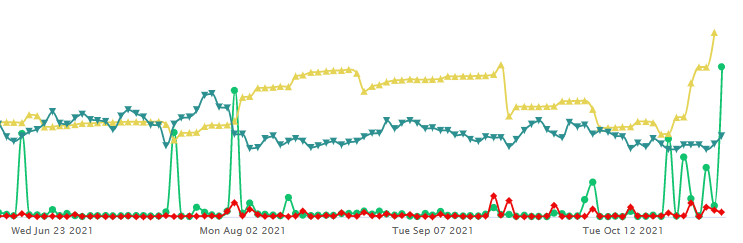

Visualized above is the current standing strategy’s profit and loss chart at its new expiration of November 5th, 2021.

To view more information about UAA's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Suncor Energy Inc. (SU)

Again, in the NYSE, we saw unusual or noteworthy options trading volume and activity today in Suncor Energy Inc. (SU), which opened at $25.93.

There were a total of 6,000 contracts traded between two orders of 4,200 and 1,800 contracts on the $30 strike call option, bought to open at the ask, dated for January 21st, 2021. N.B., the 4,200 lot was at a more competitive spot price.

Additionally, there were another 6,000 contracts traded on the $35 strike call option, sold at the bid, and for the same date.

Altogether, these contracts represent a diagonal calendar spread, approximately 1,200,000 shares, and $489,000 in premium traded.

These orders come in after Rod Nickel from Reuters reported:

“The company reported a net profit of C$877 million ($710.58 million)for the third quarter after losing money a year earlier”

As seen, bullish premium accounts for 68.9% of the options chains, with the same percentage as ask-side orders, as 100% of the options chains at these premium levels are in call premium.

To view more information about SU's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Texas Roadhouse, Inc. (TXRH)

Finally, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in Texas Roadhouse, Inc. (TXRH), which opened at $86.69.

There were 5,300 contracts traded on the $90 strike put option, around the mid spot price, dated for November 19th, 2021.

Additionally, there were another 5,300 contracts traded on the $95 strike call option, bought to open at the ask, dated for May 20th, 2022.

Altogether, these contracts represent approximately 1,060,000 contracts and $6,700,000 in premium traded.

Furthermore, these contracts are likely rolled options from our previous report, a continuation of this whale’s strategy on Texas Roadhouse, Inc.

As stated, these orders come after our initial report in which we spotted these contracts being set up for the first time.

As of this writing, TXRH has had 24,733 calls traded, which is 1,546% above its 30-day call volume average.

To view more information about TXRH's flow breakdown, click here to visit unusualwhales.com.