Unusual Options Activity in Virgin Galactic Holdings, Inc. (SPCE), MoneyGram International, Inc. (MGI), and Vale S.A. (VALE)

Unusual Options Activity in Virgin Galactic Holdings, Inc. (SPCE)

Today, February 15, 2022, in the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Virgin, which opened at $8.93.

- There were a series of orders on the $10, 10.5, and $11 strike call options dated for February 18th, 2022, all bought to open at the ask. The sizes of these orders ranged anywhere from 161 to 300 contracts traded at a time, each representing $1,000 to $6,000 in premiums of betting at a time.

- The open interest on the $11 strike call option chain as of this morning’s open was 6,656 contracts. The volume thus far is now over approximately 12,801; therefore, we may intuit that some of these traders are opening positions, either buying to open or selling to open, not closing.

Please note, Virgin reporting its earnings on February 22nd, 2022, after market close.

Additionally, these orders were spotted in the new Unusual Whales hottest chains page with a high acceleration factor; this implied that more orders outside of a standard deviation were being opened on this chain.

As stated, the volume on this chain is surpassing its open interest. Read this Twitter thread to learn more about why this is significant.

To view more information about SPCE's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in MoneyGram International, Inc. (MGI)

In the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity in MoneyGram International, Inc. (MGI), which opened today at $10.54.

- There were 10,000 contracts traded on the March 18th, 2022 expiration date for the:

- $11 strike call options bought to open at the ask at a spot price of $0.14 with a bid-ask spread of $0.10 to $0.15.

- $9 strike call options bought to open at the ask at a spot price of $1.56 with a bid-ask spread of $1.50 to $1.60.

- These orders have now come after the announcement that MoneyGram is “to be acquired by Madison Dearborn Partners for $11 per share.”

A tip from the flow: Trades appended with the ↕ emoji are trades that have potentially came in together as a part of a strategy, and are coded accordingly as MLET or MLFT, under the codes column. Click on that emoji will open all of the trades that came in together so that the holistic strategy may be investigated.

- Of interest, these orders were marked as “floor”. Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag. Click here to read about floor traders' performance.

94.92% of the premium traded at the $30,000 levels are in bullish bets, with a great majority of betting being in call premiums. Furthermore, the $5,000 premium levels are in bullish premiums at 81.50%, with a similar amount of call and put premiums traded. As can be seen, the overall options order flow on MoneyGram is bullish.

To view more information about MGI's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Vale S.A. (VALE)

Finally, and again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Vale S.A. (VALE), which opened today at $17.24.

- There were 5,000 contracts cross trades on the $17 strike call option dated for January 19th, 2024 bought to open at the ask at a spot price of $2.85 with a bid-ask spread of $2.63 to $2.87. The volume on this chain is now nearly 5K and the open interest as of this morning’s open was approximately 1.6K contracts open.

Please note, Vale reports its earnings today, February 24th.

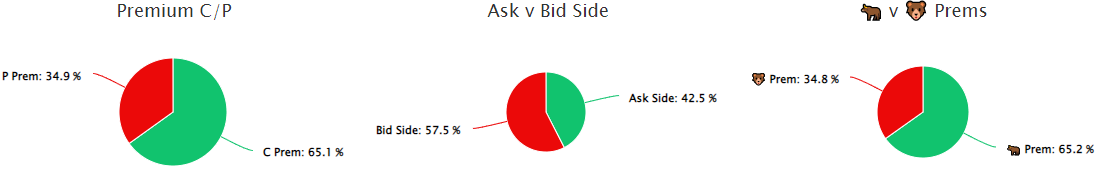

65.2% of the premium traded is in bullish bets, with 65.1% of the premium traded is in calls, with 42.5% as ask-side orders. The put call ratio for Vale is 0.96, which is bearish.

A tip from the flow: The put/call ratio (P/C) is put volume divided by call volume. Put/call ratio is important and can be an indication of sentiment shifting. A P/C greater than .7 means more puts are being bought than calls, so the trend is getting bearish. A P/C of .7 to .5 is becoming more bullish. (This distinction is made because more calls are often traded than puts, so a P/C of 1 is outside of the median.)

To view more information about VALE's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.