Unusual Options Activity in Vroom, Inc. (VRM), Everbridge, Inc. (EVBG), and Pacific Biosciences of California, Inc. (PACB)

Unusual Options Activity in Vroom, Inc. (VRM)

Today, December 16, 2021, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in Vroom, Inc., which opened at $11.11.

- There were 1,331, 666, 555, and 400 contracts traded on the $5 strike put option contract dated for July 15th, 2022, sold to open at the bid, representing approximately 295,200 shares and $192,000 in premium traded.

- Vroom, Inc. was trading at approximately $11.48 and $11.06 at the times of these orders, meaning the strike prices were approximately -56% out of the money from the underlying stock price.

These orders come after their most recent earnings report.

Friday, there was 2 open interest on this chain, and with open today 102 contracts existed. Therefore, the 3,945 volume today could only be considered as being bought or sold to open, as they are entirely new positions taken.

To view more information about VRM's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Everbridge, Inc. (EVBG)

Within the Nasdaq Global Market Composite (NasdaqGM), we saw unusual or noteworthy options trading volume and activity in Everbridge, Inc. (EVBG), which opened today at $65.00.

- There were 1,050 contracts traded upon the $65 and $80 strike call options, both at the ask and dated for January 21st, 2022.

- These orders came in as floor trades. Floor traders work on the floor of an exchange; when a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag.

- On the Unusual Whales blog there is a report on floor traders' performance. Here is a snippet:

More interestingly, we found that floor traders do not bet on crazy far OTM calls. Instead, most of the purchased weekly calls are ~10% ITM, with about a 40% chance to turn a profit. And when it comes to OTM calls, nearly half of these trades end up making gains and roughly a third of them can hit 50% and above.

These orders come after Rachel Warrenand Brian Withers of The Motley Fool wrote on key investor highlights after Everbridge, Inc. reported earnings for the third quarter.

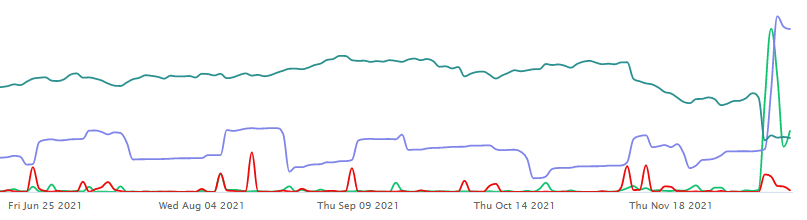

As seen, on Monday, December 13th, call volume had reached a new high of 16,629 calls traded. Yesterday, the 15th, only 4,610 calls were traded. Everbridge, Inc.’s 30 day call volume average is 1,600 calls traded in a day.

To view more information about EVBG's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Pacific Biosciences of California, Inc. (PACB)

Finally, and again in the NasdaqGS, we saw unusual or noteworthy options trading volume and activity today in Pacific Biosciences of California, Inc. (PACB), which opened at $22.39.

- There were 5,100 contracts traded on the $21 strike put contract, dated for December 31st, 2021, bought to open at the ask.

- Additionally, there were another 5,100 contracts traded on $22 strike, but for this week’s expiration, December 17th, 2021.

- If these contracts were traded together, it could be interpreted that a trader was rolling their contracts out to a later date and lower strike.

These orders come after large outflows were reported by BNK Invest.

As seen, there was 6,649 open interest on this chain as of this morning’s open; therefore, with the 5,100 volume today, it may be intuited those were the original contracts as this chain had an additional 3,005 volume yesterday which also decreased its open interest into today. Using the historical flow overview, it is possible to see traders rolling their contracts to later expirations in this manner.

To view more information about PACB's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.