Unusual Options Activity in Western Digital Corporation (WDC), FuelCell Energy, Inc. (FCEL), and Momentive Global Inc. (MNTV)

A Review of Unusual Options Activity in Western Digital Corporation (WDC)

Today, March 09, 2022, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options activity in Western Digital, which opened at $47.11.

- There were 3,239 contracts traded on the $47.5 strike call options for April 14th, 2022 bought to open at the ask of $3.40 with a bid-ask spread of $3.25 to $3.40.

A tip from the flow: Trades appended with a briefcase emoji can be intuited as bought or sold to open. This determination is made if the size of the trade was greater than the chain's open interest. Only trades that can be positively identified as being bought or sold to open will be marked as such (with the briefcase).

Additionally, these orders come after Zacks Equity Research reported that:

“On Feb 9, 2022, Western Digital had disclosed that on account of contamination of certain material used in its manufacturing processes, production operations at both its Yokkaichi and Kitakami JV, and flash fabrication facilities had been hampered.”

Only 13.4% of the premium traded at these premium levels are in bullish bets, with just 9.8% as ask-side orders, and 96.1% are in call premiums. Compare that to:

By contrast, 51.3% of the premium traded at these premium levels are in bullish bets, with 51.3% as ask-side orders, and 100% are in call premiums. The orders in this report have moved the largest betting sizes to now being bullish, in spite of an overall bearish options order flow.

To view more information about WDC's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in FuelCell Energy, Inc. (FCEL)

In the Nasdaq Global Market Composite (NasdaqGM), we saw unusual or noteworthy options trading volume and activity in FuelCell Energy, Inc. (FCEL), which opened today at $6.34.

- There were a series of repeated orders on the $6 strike put option dated for July 15th, 2022 traded at the ask of $1.41 with a bid-ask spread of $1.36 to $1.41.

- Be mindful, these orders come ahead of FuelCell Energy reporting its earnings on March 10th, 2022, before market open.

A tip from the flow: When viewing alerts in the Unusual Whales flow alerts page, you can click “Link to flow” to view chain’s activity in the overall options order flow, as seen here:

An options sweep (or sweep-to-fill) occurs when a broker splits an order into many parts in order to get the best possible pricings currently offered on the market.

These orders can often be filled across multiple exchanges and the broker will continue to fill the order lot by lot, always for the best possible price, until the order is completely filled.

Sweeps might stand out because they imply some entity (or entities) wanted to enter specific options contracts regardless of their price, as they were focused only on having their entire bulk order filled as quickly as possible. While the magnitude of sweeps might stand out, each one must be investigated thoroughly to understand what the sentiment of a trader is as compared to the overall flow.

The $6 strike put option now has approximately 134% greater volume than the second highest chain, the $7 strike calls, but all four of these utmost chains have seen repeated activity today and are more voluminous than their average sizes, coming ahead of the earnings report tomorrow before market open.

To view more information about FCEL's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Momentive Global Inc. (MNTV)

Finally and again in the NasdaqGS, we saw unusual or noteworthy options trading volume and activity in Momentive Global Inc. (MNTV), which opened today at $14.48.

There were two sets of options contracts purchased on the April 14th, 2022 expirations:

- There were 5,000 contracts traded on the $15 strike call option dated for April 14th, 2022 bought to open at the ask of $1.50 with a bid-ask spread of $1.00 to $1.50.

- The open interest on this chain was approximately 1.6K and the overall volume amounts to just above this 5,000 lot, meaning this singular entity holds the interest on this chain going forward.

- Additionally, these orders come after BNK Invest reported that on Monday, Momentive Global entered into oversold territory, hitting an RSI reading of 27.9, after changing hands as low as $13.86 per share..

Of interest, these orders were marked as “floor”. Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag.

Click here to read about floor traders' performance.

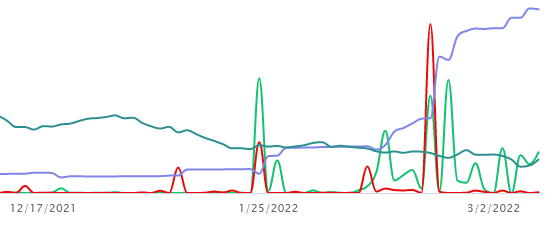

As of this writing, Momentive Global has had 7,304 calls traded, which is 243% greater than its 30-day call average. Furthermore, open interest on all of Momentive Global’s chains has climbed now to 137,076 as of today’s open, from 32,390 just a month ago, on February 10th, 2022.

To view more information about MNTV's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.