US government debt, per Bank of America, $BAC

US government debt, per Bank of America, $BAC:

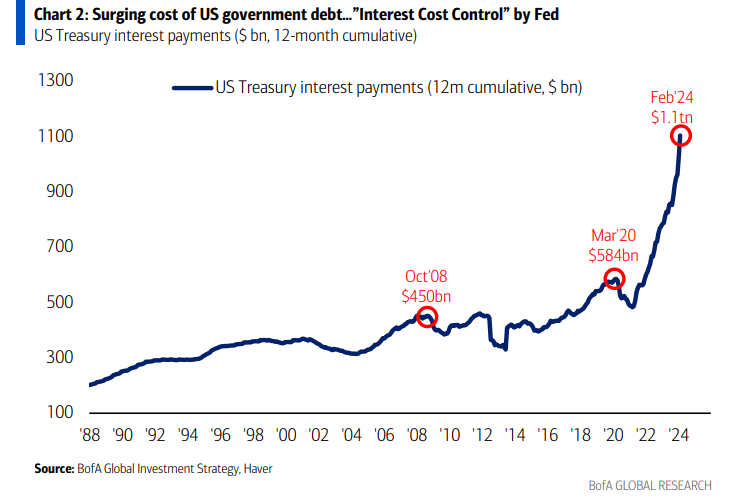

The Congressional Budget Office's (CBO) latest forecasts, released earlier this year, are based on optimistic assumptions, covering various aspects from tax revenue to defense spending and interest rates. According to these forecasts, if we factor in the current market's outlook on interest rates, the debt-to-GDP ratio could reach 123% by 2034. Additionally, assuming that most of the tax cuts implemented during ex-President Donald Trump's tenure remain in place, the debt burden would increase further.

Given the uncertainty surrounding these variables, Bloomberg Economics conducted a million simulations to assess the fragility of the debt outlook. Shockingly, in 88% of the simulations, the results indicate that the debt-to-GDP ratio is on an unsustainable trajectory, meaning it would increase over the next decade.

To address this issue, the Biden administration has proposed a budget that includes several tax hikes targeting corporations and wealthy individuals. They believe this approach will ensure fiscal sustainability and manageable debt-servicing costs.

Treasury Secretary Janet Yellen emphasized the need to reduce deficits and maintain fiscal sustainability, highlighting the administration's proposals for substantial deficit reduction and manageable interest expense levels. However, achieving these savings would require bipartisan cooperation in Congress, which is currently deeply divided along partisan lines.

Despite these efforts, delivering on such a plan remains challenging. Republicans advocate for significant spending cuts to reduce the deficit but haven't specified where these cuts would occur. On the other hand, Democrats argue that spending is not the primary contributor to deteriorating debt sustainability, pointing instead to interest rates and tax revenues. Neither party supports reducing benefits from major entitlement programs.

It may take a crisis, such as a disorderly rout in the Treasuries market triggered by credit-rating downgrades or a panic over the depletion of trust funds like Medicare or Social Security, to force action. However, relying on such events is risky.

A similar scenario played out in Britain in fall 2022, when then-Prime Minister Liz Truss's plan for unfunded tax cuts caused turmoil in the gilt market. The rapid increase in yields prompted the central bank to intervene to prevent a financial crisis, ultimately leading to the plan's cancellation and Truss's resignation.

Although the US is less likely to experience a similar crisis due to the dollar's status as the dominant reserve currency, any erosion of investor confidence in US Treasury debt would have significant repercussions. It could not only increase financing costs but also diminish US global power and prestige.

Overall, while the CBO's forecasts are based on plausible assumptions for key variables like GDP growth, inflation, and interest rates, some underlying assumptions appear overly optimistic. For instance, the CBO must assume that existing legislation, including the expiration of the 2017 Trump tax cuts in 2025, remains unchanged. However, even President Biden seeks to extend some of these provisions. Additionally, the CBO's assumption that discretionary spending will only increase with inflation, not GDP, is questionable, especially given current geopolitical challenges and ongoing military engagements. Market participants also have doubts about the CBO's rates outlook, with forward markets indicating higher borrowing costs than the CBO assumes.

Bloomberg Economics' forecast model, using market pricing for future interest rates and bond maturity data, suggests that debt could reach 123% of GDP by 2034, with debt servicing costs exceeding 5.4% of GDP. This amount is more than 1.5 times what the federal government spent on national defense in 2023 and comparable to the entire Social Security budget.