When the CEO Says AI Could Do His Job — Sundar Pichai Calls Time on Human Execs

“Maybe one of the easier jobs for AI to replace,” — Pichai admits the disruption is real

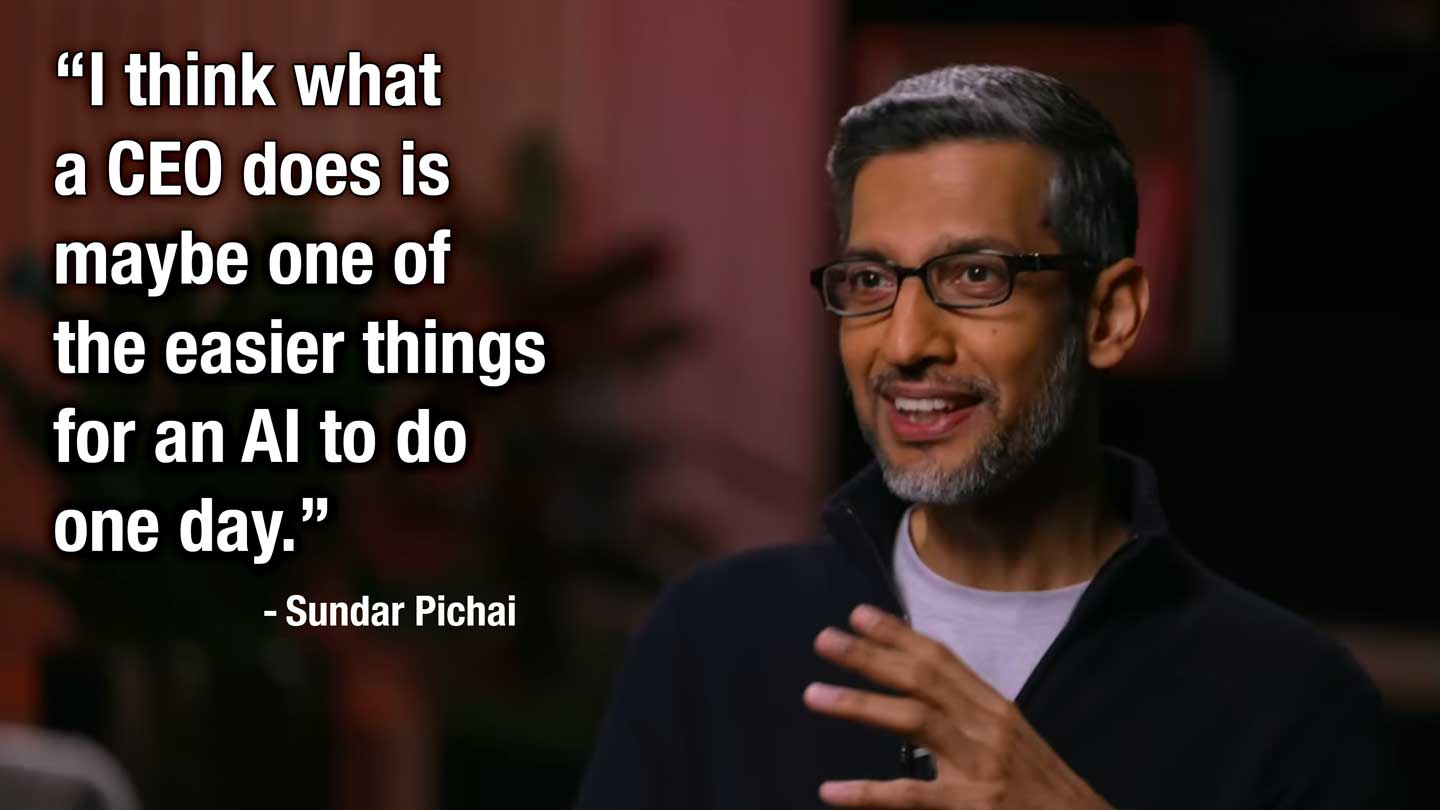

In a blunt interview with the BBC, Google’s head honcho, Sundar Pichai, dropped a bombshell: “I think what a CEO does is maybe one of the easier things maybe for an AI to do one day.”

He didn’t hedge much. Pichai said that within the next 12 months, AI will evolve from “just answering questions” to acting as an agent — capable of performing “complex tasks” autonomously.

He also acknowledged the risks: societal disruption, job displacement, and the need for people to adapt if AI begins shouldering more high-level responsibilities.

This isn’t hype — it’s a horizon statement from one of the most powerful tech leaders alive. And it casts a long shadow over how we value companies, their leadership, and their future earnings.

Watch Sundar Pichai's full interview with the BBC:

The moment referenced in this article happens @6:30

Why markets and investors should care

AI isn’t just a productivity boost — it’s a catalyst for re-rating entire sectors

If AI can handle senior-level roles, entire corporate cost structures shift. Compensation budgets, headcount forecasting, even M&A strategies could change. That forces investors (and traders) to reconsider what “labor costs” even mean — and whether legacy valuations hold up.

A potential reckoning for “human capital” companies

Firms that trade on human expertise — consulting, financial advisory, creative agencies, even certain types of management services — may see their value proposition re-examined if AI becomes a credible substitute.

Volatility ahead for AI-heavy and traditional names

Some companies may rally if they’re leaders in AI and automation. Others — especially those anchored in manual labor, service, or high headcount — could see pressure from a devaluation in human-driven output. That leads to a divergence in performance across sectors.

Options & flow implications: where the smart money might go (or run from)

- High-beta / AI-centric tech names: Could see increased call buying as traders position for upside — especially those whose business model benefits directly from AI adoption (cloud providers, AI-infrastructure firms, software-to-AI migration plays).

- Legacy labor-intensive sectors (services, manual-labour, traditional enterprises): Might see elevated put open interest or skew — a hedge against disruption, or bearish bets on structural headwinds.

- Corporate-software / automation plays: Likely to attract hedgers building positions ahead of broader corporate adoption cycles; expect higher GEX and open interest.

- Large cap “FAANG-/Big Tech-style” names with entrenched AI roadmaps: Could see position-building in both calls and puts — as investors brace for both upside and volatility.

In short: within the next 12–18 months, the options market could increasingly reflect structural bets on automation — not just short-term events.

Stocks to watch — where AI replacing roles could create moves

- Big Tech & cloud infrastructure — names that power AI tools, cloud compute, data centers, and enterprise automation.

- Enterprise SaaS companies pivoting to AI features or automation-first bundles.

- “Legacy labor” sectors — services, staffing, certain consulting firms — that may get disrupted if AI becomes a credible alternative.

- Firms investing heavily in AI R&D or hiring surges — possibly early adopters of AI-enabled management/ operations.

Monitoring unusual options flow, rising open interest in calls (on AI-centric names) or puts (on labor-heavy firms) via a platform like Unusual Whales could help flag early rotation before fundamentals shift.

Do you want to see how to make more plays? Do you want to find gains yourself?

Unusual Whales helps you find market opportunities through our market tide, historical options flow, GEX, and much, much more.

Create a free Unusual Whales account to start conquering the market.

The long game: AI as the great rerater

When a CEO says their own job might be “easy” for AI — that’s not fearmongering. It’s a warning.

Investors need to reckon with a future where intangible factors like human capital and labor costs are being rewritten. Value may shift toward those who own the infrastructure, the models, the automation — not the humans.